Would You Pass the Trader Test?

Never before have grades been so important. They are the yardstick by which we measure ability. It seems you can’t get anywhere nowadays without good grades.

I was speaking with a friend the other day. She works at a big multinational in Sydney. It turns out, a university degree is the bare minimum to get a job interview — although a Masters would be better.

Now that’s a tall order. It automatically culls a big chunk of the populace.

So are grades really the be-all and end-all?

Well, Google says no. Laszlo Bock is Google’s Senior Vice President of people operations. He says that grades on your own are not a good predictor associated with career success.

Google instead hones within on something called understanding agility. This is essentially an individual’s ability to adapt. These flexible thinkers can move outside their own comfort zone and learn from mistakes.

And you know what. A 2011 study ranks learning agility as the best indicator of achievement — outscoring both IQ and education. So maybe the highest score isn’t the best guide after all.

I lately read a fascinating study. It centred on cadets at the West Stage Military Academy. And again, grades are in the heavy of it.

You see, entry levels are a key input in judging who’ll make it through. But it turns out there is a better predictor — the ‘Grit Test’. It essentially measures persistence and resilience.

The findings were amazing. Cadets with high Grit scores were most likely to complete the gruelling program. It was regardless of their academic levels.

And it makes sense. You don’t have to be the school dux to excel. But you will not make it big by quitting after an early setback.

So once again, high grades aren’t the best indicator of success. There are more factors to consider. Only then can you make a precise assessment.

The idea that high levels predict success has importance to trading. You see, many people believe good traders have high win rates. These people view the strike rate as a key measure of success.

Let me personally give you an example. It’s from a conversation I had a few years back at a wedding.

I got talking to a guest about buying and selling. He was working at a telco. But his goal was to be a trader. I was working at Bankers Trust at that time, and my new buddy wanted to know all about this.

One question sticks in my mind. He or she asked me what my hit rate was. In other words, he was asking what rates of my trades made money.

My answer was about 35% to 40%.

I remember his response vividly. He said ‘Oh, that’s honest‘

I paused as it were. Then it struck me. He or she though a low strike rate was bad. In his mind, I was confessing that my trading career was in tatters. We had a serious disconnect.

I then added some key information. This made all the difference. I explained my average winning industry was more than three times my personal average loss. This intended I was actually a very profitable trader.

But I can understand the misunderstandings. The internet is full of ads for every type of trading services. Many claim to have exceptional strike rates. This plays on the thinking that ‘high grades’ equal success.

Have a look at the following table.

|

Trader A |

Trader B |

Trader C |

Trader D |

|

|

Strike rate |

86.9% |

67.1% |

62.3% |

60.4% |

Suppose you want to hire a trader. Whose CV can you look at first?

Most people might go with trader A. Again, it’s that natural tendency to link a high quality with success. But that’s only part of the story. Let me add some more information.

|

Trader A |

Trader B |

Trader C |

Trader D |

|

|

Strike rate |

86.9% |

67.1% |

62.3% |

60.4% |

|

Profit |

$62,182 |

$80,267 |

$104,587 |

$126,369 |

Trader A is no longer the surface of the class. It’s trader Deb making the most money.

These aren’t the random set of numbers. They are actually from some back-testing I did last week. My aim was to test two exit methods — taking profits and allowing winners runs.

All I did had been modify Quant Trader‘s exit algorithms. There were no changes to the admittance or risk management methods. The test period is between 1 January 2009 and 10 July 2015. Each industry is for $1,000. And there is no allocation for costs or dividends.

Here’s the final table. It shows the results from four situations.

|

5% take profit |

20% take profit |

100% take profit |

Let profits run |

|

|

Strike rate |

86.9% |

67.1% |

62.3% |

60.4% |

|

Profit |

$62,182 |

$80,267 |

$104,587 |

$126,369 |

|

Number of trades |

2577 |

1007 |

605 |

551 |

|

Ave profit per trade |

$24 |

$79 |

$173 |

$229 |

The first two strategies are similar to how many individuals trade. Locking in an earlier profit typically leads to plenty of small wins. The problem with this is that it caps profits.

The third strategy gives profits scope to run. It then takes revenue if a stock rises through 100%. The final example is Quant Trader. Earnings are let run until the inventory hits its trailing quit.

Now, you may be thinking the 5% take profit strategy isn’t that bad. It appears to make good money. And you get plenty of winners to boot.

But there’s a catch

Look at the number of trades whenever you take 5% profits. Now consider the average profit per industry. This strategy may well lose money following brokerage.

And don’t forget, these tests use Quant Trader‘s entry and danger management strategies. Many investors don’t have a robust method for either.

The 20% take profit strategy is a little better…although it’s no stand apart.

It’s only when we let the those who win run that things get interesting. The number of trades drop, and profitability rises. The longer holding periods are also more prone to result in dividends.

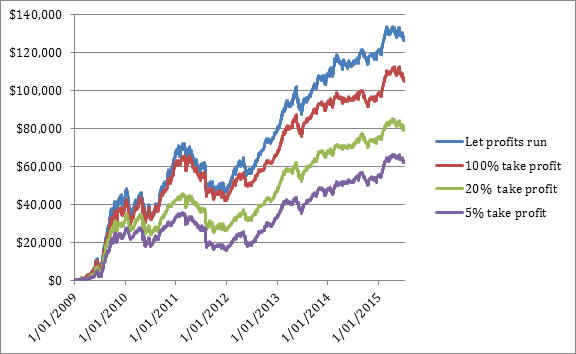

I have one last thing to show you. The following chart brings all the numbers to life. This graphs the hypothetical performance of the four strategies.

There is no doubt about it. Letting those who win run makes a huge difference. Certain, you’ll have a lower strike price. But that’s okay. A high hit rate is not a good predictor of success.

Trading isn’t about becoming right more often…it’s about earning money.

Until next week,

Jason McIntosh,

Editor, Quant Trader

Editor’s note: Are any of your stocks up 89% in the last nine months? Chances are the answer is no. The All Ordinaries is lower, so normally many ASX stocks are down as well. But that doesn’t mean there aren’t any opportunities — you just need to know where to look.

Quant Trader has just locked in a good 89% gain on a stock known as Pro Medicus [ASX:PME]. And there are open positions along with even bigger gains. Click here to find out how you can buy stocks such as PME for your portfolio.