Here’s One Sector You Want to Keep a Close Eye On

You’ve probably heard plenty concerning the usual economic trends, such as the trend in business confidence or the trend in interest rates. I love to think of these as micro-trends.

What a person likely haven’t heard much — if anything — about are the macro-trends functioning above these micro-trends. Over in the US there are several macro-trends all converging into 1 sector. Making this particular field, one to watch.

Macro-trend number one is the ageing US population. According to data from the US Census Bureau, there are around Seventy six million baby boomers living in the united states today. That’s almost one fourth of the US population. It’s an extraordinary number to be coming into their own retirement years.

The second macro-trend is that many of the baby boomer generation don’t have enough in their retirement savings. This really is from a recent article within the New York Times:

‘On average, a typical working family in the anteroom of pension — headed by somebody 55 to 64 years old — only has about $104,000 in retirement funds, according to the Federal Reserve’s Survey associated with Consumer Finances.

That’s not nearly enough. And the situation is only going to grow worse.

‘The Center for Retirement Research at Boston College estimates that more than 1 / 2 of all American households?will not have enough retirement income?to maintain the living standards they were familiar with before retirement, even if the people in the household work until 65, two years longer than the average retirement today.’

The third macro-trend is rising property prices. While they may not have enough savings, many of these baby boomer retirees possess considerable equity locked in their houses.

Rising property prices, insufficient retirement funds and an ageing populace all converge to make manufactured home estates an appealing option to boomers who wish to downsize.

This sector offers a low cost real estate option in comparison to traditional homes. It allows residents to free up the locked equity within their home to spend on their retirement years.

I’ve mentioned manufactured real estate estates before. Called MHEs for brief, these are places where citizens, generally over the age of 55, personal their factory-made homes but spend a weekly site rent towards the owner-operator.

It is useful to look at the US market because in the US, manufactured home estates are a far more mature sector than in?Australia. Seeking to the US can give you a good indication of what lies ahead for this sector here in Australia.

In the US, the 2 major listed companies within this sector are Equity Lifestyle Qualities Inc. [NYSE:ELS] and Sun Communities Corporation. [NYSE:SUI].

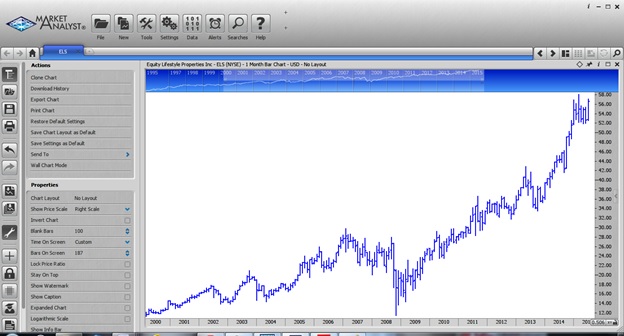

Equity Lifestyle Properties is the largest operator. Here is the monthly chart for Equity Lifestyle Qualities.

Equity lifestyle properties monthly club chart

Source: Market Analyst

The chart tells you that the weight of money in the US suggests there’s a strong demand for this kind of housing. If you bring up the chart for Sun Communities, you’ll see a similar story.

You can see this stock bottomed out in The fall of 2008, months before the common market did in 03 2009, signaling this company was in a powerful position. Why?

The residents of those manufactured housing estates possessed their housing units outright. There were no unaffordable home loans purchasing an unaffordable property price. In this instance, there is no property to buy; it is leased in the operator. Can you see that these residents experienced none of the credit score exposure associated with the broader economy, such as sub-prime?

Profits for this company is determined by how cheaply they can buy land. As the GFC ran it’s course and land costs in the US continued to decline, the organization could make further acquisitions cheaply. This increased profitability, not to mention the share price quickly factors this in. From the GFC levels this company has been in a strong upward trend ever since.

Over at Cycles, Trends & Forecasts, this really is precisely what we show as well as teach you. How to identify this kind of megatrends and take advantage of them before these people happen. The biggest trends ALWAYS involve the economic rent — the largest which is land value. If you don’t understand this, you can find out more right here:

The US economy generally leads Australia, so this is one field you may want to follow closely right here. It’s why, at Cycles, Trends & Forecasts, we study the US first. And of course, Australia faces all the same problems as the US; an ageing population, baby boomers with insufficient funds to retire, and rising property costs.

But can you see why these properties are so appealing and reasonable for retirees? Sure the structures, built prefabricated in a manufacturing plant, are cheaper than a normal website built house. But that’utes only half the story.

When brand new residents buy into one of these properties they are buying the house only, not the land underneath. They pay that like a weekly site rent. Take away the huge hurdle of upfront land costs, replace it having a site rent and all of a sudden housing becomes much more inexpensive.

On the Australian stock exchange, we have several companies that are involved in this sector, including Ingenia Communities Group [ASX:INA], Lifestyle Communities Ltd [ASX:LIC], and Aspen Group[ASX:APZ]. Last month they were joined by a new player, Gateway Lifestyle Group [ASX:GTY], which is seeking to profit from this emerging trend and it is now the largest?player within the Aussie market. This is a company you can follow now to monitor the Aussie real estate cycle. We suggest you watch as this newly listed company continues an aggressive acquisition drive in order to capture and collect the rent.

According to chief executive 4 Ottawa, the business has been profitable through day one, with most residents receiving the age pension and rent assistance from the federal government. Guaranteed earnings for the company, in other words.

Another advantage for the operator is that the citizens own their homes, so the owner is not liable for any servicing.

The weight of money in the US is actually indicating this is a hot field. It looks like it also will become an appealing option to the first waves from the boomer generation here in Australia, a lot of whom have insufficient super funds to fall back on.

The just unknown factor for many is actually land price. Should land prices go higher, this real estate option will become ever more popular as retiring boomers unlock the actual land value in their home.

Land price is key to the cycle. Nobody ever teaches you to follow this. Except over at Cycles, Trends and Forecasts. It is so important for your own investing success to understand this particular. History clearly shows that the period unfolds in a predictable series and timing.

You can use which sequence and timing from the real estate cycle to your expense advantage. To learn more go here.

Regards,

Terence Duffy,

Contributing Editor, Money Morning

Editor’s Note: The above article had been originally published in The Daily Reckoning.

From the Port Phillip Publishing Library

Special Report: The Golden Age of Infrastructure China just unveiled a $100 billion international investment bank for a solitary mission: Rebuilding the 2000-year old Silk Road trading path. Why? Because the Middle Empire is determined to redraw the global financial map…and establish a new world order of trade. Therefore it is kick-starting what could be the biggest infrastructure boom in history…and handing you a once-in-a-lifetime value investing opportunity in two companies that could double within price once this new ‘Golden Age of Infrastructure’ dawns…