Saudi Arabia Waits out the Competition

The undisputed king of oil and gas is making some techniques that could change the face from the global refining sector.

In June 2015, Saudi Arabia pumped a record 10.564 million barrels a day. As if being the world's biggest exporter associated with oil was not enough, the desert kingdom is now seeking to conquer the refining sector, as it has quickly become your fourth largest refiner in the world.

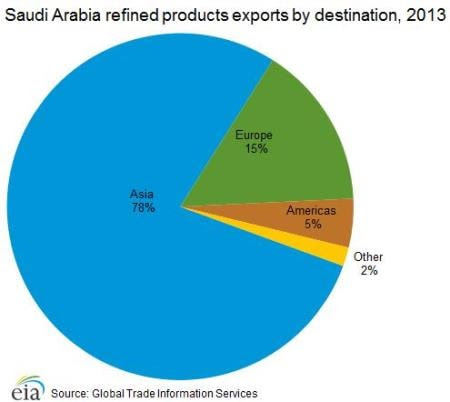

"Saudis have relocated into the product business in a big way," said Fereidun Fesharaki of FGE Energy. With Saudi Arabia's refined fuel adding to the global supply glut, what’s going to be its impact on the refining markets especially those in Asia.

How will Saudi Arabia Catch Market Share Downstream?

Gross refining margins measure a refinery's success. The gross refining margin is certainly not but the difference between the value of the refined products and price from the crude oil. In case of Saudi Arabia, the cost of crude oil would be extremely reduced. "The crude is so cheap it's pretty much free on their behalf, the margins are going to be huge. It makes trade flows within products very different," said Amrita Sen of Energy Aspects.

There is little doubt after that as to why the Saudis are transferring their focus to domestic refining. Along with acquiring a managing stake in Korea's S- Oil, the desert kingdom is actually commissioning a new refinery in Jizan that would possess a capacity of around 400,Thousand barrels per day when it starts operations in 2017. Jizan will come on top of Saudi Arabia's two other 400,000 bpd- refineries at Yasref and Yanbu, and will turn the country into a main global player in the downstream field, expanding its campaign with regard to market share beyond just crude oil.

Is Saudi Arabia likely to win a potential price war against Asian producers of diesel?

By offering almost 2.8 million barrels of low-sulphur diesel to Asian and European markets, the Saudis are directly competing with Asian refiners, potentially sparking a price war. In fact, at $5.Sixty the Asian refining margins have fallen by nearly 50 percent from June this season and expect to drop by a further 30 percent.

"We see refining prices weakening on worsening diesel-powered fundamentals, particularly east of Suez, though gasoline should be supportive. A lot of diesel will be trapped in the Far East and this will lead to operate cuts in places like Japan and South Korea because the arbitrage to the west will be shut by growing Middle Far eastern supplies," said Robert Campbell of one’s Aspects.

On the other hand, it will not be easy for Saudi Arabia – Chinese refiners are also producing more gasoline, for which demand is still strong. Furthermore, Indian refiners are now moving away from Saudi Arabic, that was previously India's largest crude oil supplier. Indian refiners are actually buying more crude oil from Nigeria, Iraq, Venezuela and Mexico. As a result, it forced Saudi Arabia to provide discounts on its large and sour grade associated with crude oil to its Asian clients.

Still, Saudi Arabia can likely wait out the competition. Just as they’ve kept their crude oil production levels intact, it is possible that the Saudis will maintain their current refining output in spite of falling improving margins and eventually end up successful the price war against Oriental producers.

However, one cannot easily neglect the Indian and Chinese refiners. Let us consider the case associated with Indian private refiners Essar and Reliance, which are among the most complex refineries in the world (refineries that are capable of processing weightier and cheaper crude). Both of these refineries have seen great success recently, following a recent dip in oil prices after a deal was reached between the P5+1 and Iran, and are likely to build upon their already impressive refining margins (Gross refining margin with regard to Essar refinery was $9.04 per barrel while that of Reliance was $8.70 per barrel within first quarter of 2015).

So, who will reap the benefits of the low prices?

Given current market conditions, the Asian demand for diesel has reduced primarily due to the weakening Chinese market, while demand for gasoline is growing in India, Pakistan, Thailand, the Philippines and Vietnam. The price for diesel expects to fall, and fuel prices will continue to drop if there are no run cuts in the Asian refineries.

This all translates into lower prices of refined energy sources will eventually benefit Asian clients who will pay less for transport, basic commodities and essential services.

Saudis Expand Price War Downstream is republished with permission through Oilprice.com