Invest to Make Money, Not to be Right

All investors say they want to make money.

But the truth is, most of them don’t.

They’re not interested for making money.

They’re only interested in being right.

Trouble is, in their mission to be right, they often end up being wrong.

That can cost them cash. Sometimes, a lot of money…

We’ve been favorable on this market for years.

When other people said it was too risky, we told you to buy. When others said you should sell, we told you to hang inside.

Those were the right decisions.

Now we’re issuing a this caution. You should prepare for a market accident. You’d think that after phoning this market right for most of the past seven years, investors could be glad for the warning.

But they are not. They hate it…as well as we’ve got the hate postal mail to prove it.

This isn’t a ‘fake’ crisis, it’s a real crisis

Take this particular email from subscriber, Chris, as an example:

‘Two years of buy purchase buy and now you are saying sell sell sell and all I am getting is loss after reduction.

‘You have now successfully stopped me personally investing in any shares a person recommend.‘

That’s just one example.

It’s obvious that some folks would prefer it if we didn’t warn them about a coming market accident.

They would prefer it if we kept on saying buy, buy, purchase, even though we believe the market is actually heading for a major fall.

And we aren’t just talking about one of those half-baked corrections the mainstream has cooked up over the past few years.

If we thought it would be one of those, we would tell you not to worry. But this is potentially more serious than that.

And although it’s still early days for this crash, so far we’ve got it spot on.

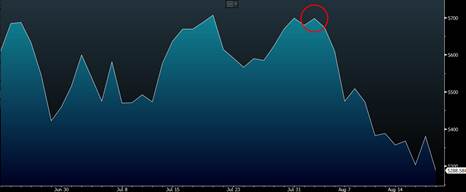

Check out this chart from the S&P/ASX 200 index. We’ve circled the date where we informed Tactical Wealth subscribers to buy two specific stocks which would profit from a falling market:

Source: Bloomberg

We’ll ask you: If a person gave you that advice, would you be grateful for the guidance, or would you reject it?

Implementing a ‘crash protection’ strategy

It’s logical to want to market at the top and buy at the bottom.

Every buyer knows that’s what you should do.

But, when it comes down to putting the theory in to practice, many investors prefer to stick to their guns.

They prefer to hold on to prove that they’re right instead of doing what’s right — in cases like this it means taking out ‘insurance’ to protect your wealth in the event of a market accident.

We’ll be clear on this. We aren’t saying that you should sell every stock you own. You should continue to hold stocks, especially if they’re having to pay you a nice dividend.

You should continue to speculate too. We’ve seen over the past few weeks that many small-cap as well as microcap stocks are holding up nicely, despite the recent fall.

But that shouldn’t stop you from taking measures to protect your portfolio.

That’s the reason why we recommended two specific ‘crash protection’ stocks in this month’s Tactical Wealth. One of those shares has gained 16%, and the other has gained 6.4%. Within the same timeframe, the S&P/ASX Two hundred index has dropped Six.9%.

We don’t know about you, but to all of us that seems like a pretty good method to achieve some peace of mind whenever stocks are going through a volatile period.

It’s OK to be wrong

But here is the bottom line. We don’t know for sure in the event that we’ll be right about the Sept or October crash.

And simply because we don’t know, that’s why we are taking precautions with our personal wealth, and why we recommend you take precautions with your wealth too.

Oddly enough, we hope we are wrong about a crashing market. We hope that the crash indicators that we’re seeing are just a fake alarm.

If they are, great. You will still own stocks in your profile, and you can easily get out of the actual ‘crash protection’ stocks we’ve recommended in order to Tactical Wealth subscribers.

Discover what they are here.

Like just about all insurance policies, it doesn’t come without some cost. By securing even part of your profile, you’ll forgo some increases if the market doesn’t accident.

But again, that’s just part of the deal with insurance policies. You take them out on the off-chance that you’ll need to make a claim…but in truth, you hope you’ll never have to.

The brief message here is, don’t worry about being right. Pay more attention to building and protecting your prosperity. And if sometimes that means changing your investment approach, then so be it.

It’s better to be incorrect about something and keep your wealth, rather than becoming wrong and it costing you a fortune.

Cheers,

Kris