Introducing a New Way to Buy Stocks, ‘Stock Showdown’

I’ve come up with a new way to buy stocks. You could almost contemplate it a game. I call it ‘Stock Showdown’.

The rules of the game are this particular:

I present you with two stocks. I’ll give you some information about these stocks. Once you’ve seen the information you have to choose which one you’d like to put your money in. Simple.

There’s 1 catch though. I won’t tell you who the companies are. You have to make your decision purely based on facts.

This way there’s no emotion attached to your choice. No bias, no preconceived ideas. You’re purely making a sound financial choice.

Sound like fun? Great. Let us play.

First off, both of these stocks are ecommerce companies. Both of them are involved in everything from online shopping in order to mobile services and impair computing. They’re almost identical.

There’s a good chance you might guess that these companies are. But let’s play anyway.

Stock Number One

The first stock has a market limit of US$155 billion. They trade at a P/E Ratio of 23.04.

In the company’s 2015 financial 12 months they had revenues of just over US$11.9 billion. Their price of revenue was around US$3.73 billion. That gives them yucky profits of US$8.2 million. Net profit is US$3.8 million.

And finally the company has US$19.Seventy four billion in cash as well as total shareholder equity of US$29.67 billion.

The current stock price is US$59.95

Stock Number Two

The second stock has a market cap associated with US$250.7 billion. There is no P/E ratio for this company and you’re going to see why.

This company’s most recent full financial year they had income of US$88.9 billion. Their cost of revenue was around US$62.7 billion. That gives them gross profits of US$26.Two billion. This company didn’t have a net profit. They had net loss of US$241 million.

Finally this company has US$17.4 million in cash and complete shareholder equity of US$10.74 billion.

The current share price is US$536.07.

Decision time

So, which stock can you buy?

If you had to choose can you buy the stock that’s making money or the stock that’s dropping it? With so much uncertainty in the markets right now exactly where would it make sense to invest?

Stock number 1?

There’s a pretty good chance based on those numbers you’d choose inventory number one.

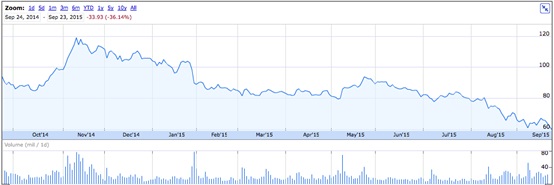

But let’s look at the stock price of number one over the last year.

Source: Google Finance

And what about the price of stock number two?

Source: Google Finance

Hang on that can not be right? Can it?

The stock that’s performing better financially (stock one) is down over 36% within the last year. The stock that’s performing worse financially (inventory two) is up 61% over the last year?

I’ll tell you which two businesses these are and why they are important in a moment. But here’s what the Financial Times had to say about them:

‘[Stock #1] return on invested capital is 8 per cent; [stock #2] is actually minus 3 per cent. Actually at a slightly slower pace, [stock #1] revenue is growing at Forty per cent against [stock #2] 17 per cent. It is [stock #2], though, that right now commands a premium valuation: it’s enterprise value is Twenty times next year’s predict earnings before interest, tax, depreciation and amortisation compared with [stock #1] from 19 times.‘

None of it really makes sense. If you look at the details stock number one comes out on the top. But the market doesn’t seem sensible at the moment. And that’s a problem.

‘Stock Showdown’ would be to demonstrate that, in the market, sometimes the reality just aren’t good enough.

Kings of ecommerce, east versus west

The two companies are Alibaba Group Holdings [NYSE:BABA] and Amazon.com Inc. [NASDAQ:AMZN]. Alibaba is inventory one, Amazon is stock two.

Now if you had known the stocks at the beginning of my small game would your decision have been the same? Or would have chosen Amazon over Alibaba? If you do choose stock one, would you now choose stock two?

If so, why?

That’s a question you should always ask yourself when investing in any kind of inventory, why?

In this case, if you’re trading based on pure fundamentals then you’d go with Alibaba. The facts don’t lie. Alibaba is a better stock. They’re the actual kings of ecommerce in China. They are a large company. And their leader, Jack Ma, is a pioneer associated with technology and commerce.

But if you are investing in hope, potential as well as promise then you’d probably opt for Amazon. It might become lucrative. It might become the biggest company in the world, one day. Amazon may be the King of ecommerce in the US and Western countries. And their leader, Jeff Bezos, is also a pioneer of technology and business.

Of course when you look at both of these companies you’re also comparing the East versus the West. And the recent slowdown in China, has dragged on the price of Alibaba. But even with which in mind, the facts don’t lie. Alibaba is an excellent stock. But the market doesn’t seem to think so.

This is indicative of the markets right now. They don’t seem to make sense. They are driven more by sentiment than fact. That causes a problem as an investor because it makes the market unpredictable.

But unpredictability also means there’s room for chance. Right now Alibaba is 37% down from its opening price when it outlined late September last year (it comes down to 10% down from its IPO price).

However it’s a whopping 51.8% down from its peak of $120 through November last year when the organization carried the same excitement that Amazon has now.

That’s opportunity. And that’s the kind of thing you should be searching for in any market you choose to purchase. Look for companies that are strong. Companies that make money, have solid fundamentals but are out of favour for no legitimate reason. Those are the kinds of stocks you want in your portfolio in the long run.

So take ‘Stock Showdown’ as well as apply it to any stocks you want. It’s a fun game and it might also make for some fantastic investments.

Regards,

Sam