Stop! Take Stock of Your Trading Strategies Today

How often do you stop and take stock of your career, relationships, or life in general?

New Year’s Day time is a popular choice for self-reflection. It’s a opportunity to consider what went nicely…and not so well. Others make use of a traumatic event as the driver. Bad news is often a spark in order to re-assess our course.

I take stock regularly. It constantly jogs my memory to be grateful when occasions are good. This mental weigh-in also keeps me focussed when things turn south. We went through a particularly tough period in the late 1990s. The actual markets were volatile and fear was rife.

Two downturn had swept through the market. The first hit came from the Asian Financial Crisis. Hot on its heels was the Russian debt default. Many thought a big collapse was imminent.

Yes, the markets did fall — the Dow misplaced a quick fire 20%. But the negativity didn’t last. Stocks were back at all-time highs within a few months. This period is merely a footnote in history for most. Although for me personally, the impact was far reaching. It was a time I had to stop as well as take stock.

Let me explain what I mean.

Financial crises are nothing brand new. They are part of the economic period. And each time it’s the exact same story. A once high flying investment bank arrives crashing back to earth. The implosion of a financial juggernaut is a headline event. But this time I wasn’t reading about it…I was living it. The financial institution under siege — Bankers Trust — was my employer.

I began 1999 as a senior investor at a top firm. By mid-year, it was all over. I was from a job for the first time in my profession. Banks across the globe were tugging back risk. There was a glut of traders. Jobs were scarce. It was a time when many people left the industry.

Taking stock of the situation was important. It put things into perspective. Sure, I didn’t work. But I knew I had valuable skills. It was just a matter of getting a way to use them.

Looking past the instant gloom was the key. It provided the emotional boost in order to stride forward. Bankers Trust’s demise felt like the end around the globe. But it was actually a golden opportunity. This was the dawn of the highly creative period in my career. Redundancy was the nudge I needed to go out on my very own. I haven’t looked back since.

Challenging times… for some

The recent market sell-off is also an opportunity to take inventory. You’ve no doubt seen a number of trades go backwards. Several have probably hit their exit points. This can be emotionally screening.

I received an interesting email this week. It’s from a member who’s already taking stock of what the correction means for Quant Trader. Here’s what he says…

‘I have just finished my monthly review of the actual Quant portfolio. I joined from the get go and after 10 months I have to say I am impressed!

‘Some feedback on numbers…

‘As this was a bit of an experiment for me, I didn’t put all my cash into the project.?I have been trading primarily long signal 1s.?It required some time to set up a CFD account to start on the shorts, however i am now trading them also.

‘I have compared the various opportunities I have over the same some time and can report the following.

‘All Ordinaries down about 4.8%

‘Blue Chips down about 11.5%

‘Speculative Portfolio (used mainly from PPP recommendations after which own research) up 12.2% (at one point this was upward 46% but last month has hurt it!!)

‘Quant Trader (excluding trading costs and dividends)

- Up 11% (open wishes)

- Up 14.8% (open + closed wishes)

- Even (shorts)

‘Forex Trading – actually

‘So all up, I would say QT and PPP in general are doing pretty well given the market and unpredictability.

‘I have now gained enough confidence in the approach that I is going to be allocating another 5-10% to the project.’

Member, Dom

This correction is proving to be Dom’s ‘redundancy’ moment. He’s using a setback being an opportunity to access various methods. There’s nothing quite as revealing as a receding tide.

The outcome of this exercise speaks volumes. Dom is more confident. As a result, he is allocating more capital to the Quant Trader strategy. I believe this will result in a better return over time.

I’m likely to add to Dom’s analysis. This will give you a clear view of how Quant Trader is tracking.

Let me say this particular. The stats I’m going to show you are below their high point. And that’s fine. A method that needs ideal conditions to show its results is not worth trading.

Slicing and dicing the actual numbers

The following figures are for the period 17 November 2014 to 17 September 2015. That gives all of us 10 months of live signals to analyse.

The very first table shows the average revenue for long trades.

|

Average Profit/Loss |

Average Days within Trade |

|

|

Open long trades |

13.5% |

159 |

|

Closed long trades |

-3.7% |

155 |

|

All Ordinaries |

-4.8% |

307 |

Now let me split this down further. This particular table separates open deals into profits and reduction. It does the same for closed trades.

|

Average Profit/Loss |

Average Days in Trade |

|

|

Open profits |

27.9% |

171 |

|

Open losses |

-6.9% |

141 |

|

? |

||

|

Closed profits |

15.7% |

196 |

|

Closed losses |

-12.9% |

136 |

The first thing you may notice is that profits are bigger than losses. Every trader wants this. But many lack a highly effective strategy to get it.

Quant Trader‘s approach is straightforward. It lets profits operate, and it cuts losses. This particular naturally leads to average earnings being higher. You won’t accomplish this by taking lots of small profits.

The other thing to note may be the average holding period. You can observe profitable trades have a greater average than losing types. And that makes sense. If a industry isn’t working, you get away.

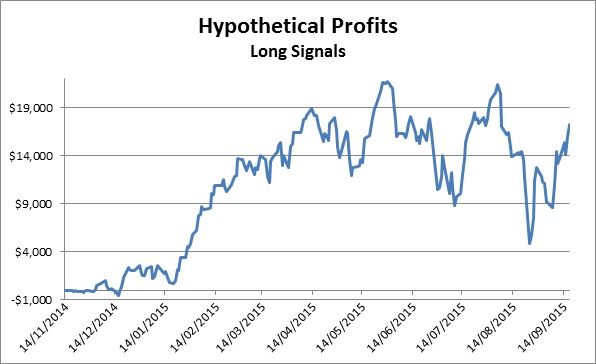

Okay, let’s put all this into a chart. I much should you prefer a visual to a table.

>

>

This exhibits the hypothetical performance of Quant Trader‘s long signals. It presumes $1,000 on every long trade. There is no allowance with regard to costs or dividends.

Now let’s consider the All Ordinaries over the same period.

The two graphs tend to be broadly similar. That’s what I expect. The undercurrent of the Just about all Ordinaries will always be a key factor. However that doesn’t mean you can’t beat the market.

A strong strategy can make a big difference. This is when Quant Trader comes in. The aim is to hold strong stocks and cut weak ones. That is the foundation of outperformance.

Anyone can make money in perfect problems. But handling the tough occasions is the acid test. To date, I think it’s fair to state Quant Trader is holding its own.

Until in a few days,

By Jason McIntosh

Editor, Quant Trader

Editor’s note: Are any of your shares up 100% in the last 10 months? Chances are the answer is no. The All Ordinaries is lower, so normally many ASX stocks are lower as well. But that doesn’t mean there aren’t any opportunities — you just need to know where to look.

Quant Trader’s top five open trades are up between 303% as well as 109%. The system’s algorithms determine stocks on the move. It then allows its winners run. Click here to find out how you could buy stocks like these for your portfolio.