What Housing Starts Forecasts Could mean for Aussie Stocks

Deutsche Bank has a positive outlook on housing starts. Their forecast could have positive implications for companies that make building items.

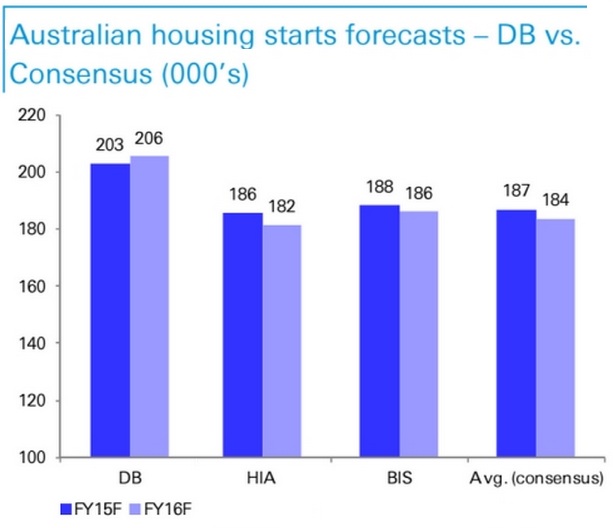

What Deutsche Bank are forecasting

Deutsche Bank expert Emily Smith says housing starts for this financial 12 months, ending June 30, will be 203,200. She estimates First thererrrs 205,600 starts in between then and June 2016.

Her optimism is dependant on two main things. First, there’s low interest rates. The RBA reduce official rates in Feb. Although it didn’t cut all of them again in April, governor Glenn Stevens suggested that there might be cuts later in the year. ABS data shows that low interest rates have already boosted lending for new homes. From The month of january 2015 to February 2015, the number of financial loans for construction of new houses went up 0.6%.

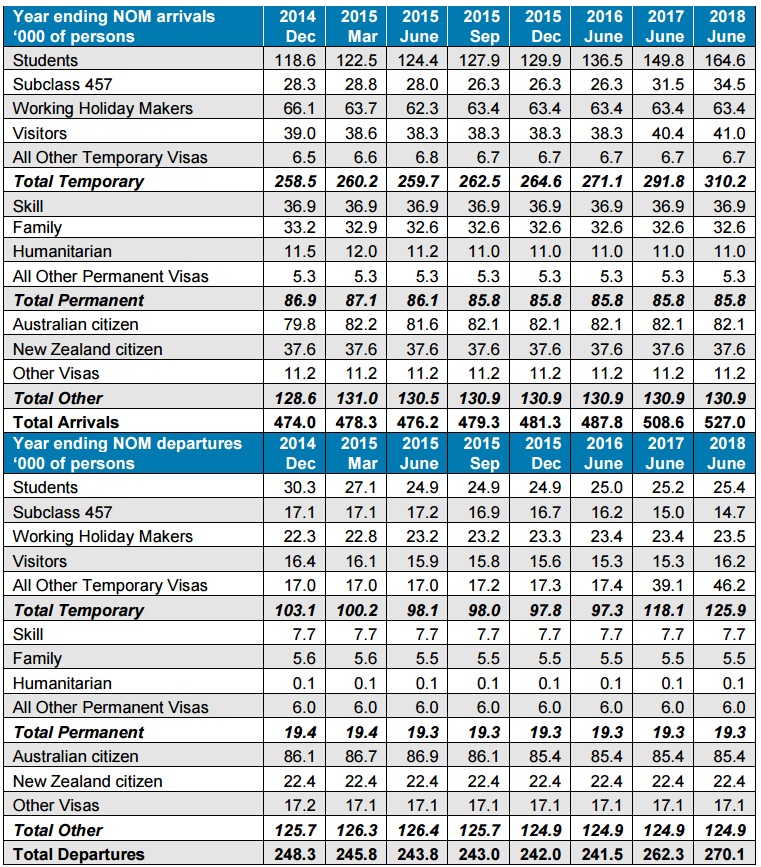

Second, there’s migration. According to the latest government forecasts, net overseas migration should remain strong up to 2018.

Source: Department of Immigration and Border Protection

[Click to enlarge]

Strong migration often drives demand for new houses. Some migrants buy their own new houses. Investors, responding to powerful rental markets, also purchase new houses.

Foreign investment guidelines also have an impact. Aside from 1 established property per person, temporary residents can only buy new properties. Even if you don’t count visitors, students and dealing holiday makers, there are still tens of thousands of short-term residents coming in who might want to buy second homes or investment properties.

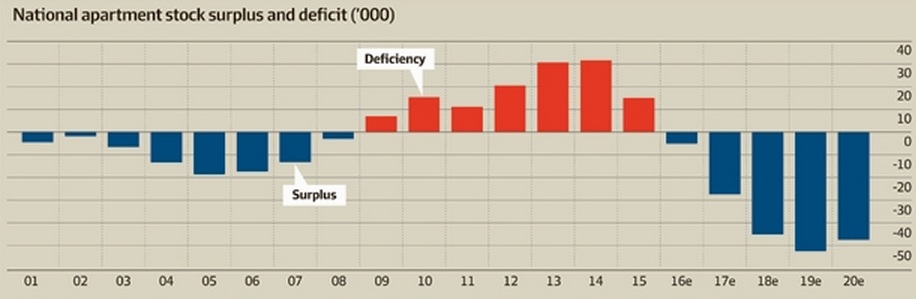

Many of these new properties are apartments. Foreign buyers tend to value fairly affordable inner city boltholes, regardless of whether they’re looking for a home or perhaps an investment.

This fits in with the forecasted strength of apartment construction. DB expects that just under 1 / 2 of all new housing starts is going to be apartments. In the past, apartment starts have only made up an average of 29% of recent housing starts.

What others say

Most other housing industry bodies aren’t because optimistic. The average of all predictions is 187,000 new starts for the year up to 06 30, and 184,000 for that financial year 2015-2016. They’re actually predicting that new creating will slow down.

Source: AFR

[Click to enlarge]

The Housing marketplace of Australia is the minimum optimistic. Their latest statement says that:

‘We retain the view that the 2014/15 year is likely to represent the peak in the current cycle, although the heightened uncertainty that comes with breaking records means further growth shouldn’t be ruled out […] Our central forecast shows that after three sequential years of strong growth, home commencements are set to decline by 5.7 per cent in 2015/16 by a further 4.7 percent in 2016/17‘

The Master Builders’ Association includes a slightly more bullish outlook. In December 2014, MBA chief economist Peter Jones said ‘At the national level, we expect dwelling begins to average 195,000 over the next four years, rising above 200,000 until the next cyclical downturn unfolds‘. In other words, they disagree using the HIA’s view that housing begins have peaked already.

BIS Shrapnel believes that new starts may drop after next year as well. They believe there’s going to be the glut in new flats, and not enough new unattached houses. In March, their own associate director Dr Kim Hawtrey said ‘We’re probably building too many apartments and not sufficient detached houses and we could find we have an unbalanced result in a couple of years’ time. We need to increasingly re-orientate the actual housing recovery to build much more detached houses and fewer connected dwellings.’ He pointed out that this would be because local and international investors are investing mainly in apartments in high-rise structures. Although that wouldn’t be good for the building sector, there’s a minimum of a little positive news for buyers. In Melbourne, for instance, BIS Shrapnel predicts apartment prices may drop by around 10% over the next three years.

Source: AFR from BIS Shrapnel data

[Click to enlarge]

Commercial building also good

The Australian Performance of Construction Index measures general construction activity in Australia. It looks at factors including orders for building materials, shipping of materials to sites, and employment in the construction industry.

The March PCI, released on the 9 of April, demonstrated an increase in house building activity. The index went up Ten.4 points to 55.8 in March. This ended three months of contraction. It had been the strongest expansion since Oct last year.

General commercial construction had been down by 1.5 points to 41.2. But new orders in the commercial building sector actually went up. Complete new orders went up Twelve.1 points to 50.8. This is good news for companies which make building materials. It seems those orders are actually being filled too. Deliveries went up Three.9 points to 50.6.

Which stocks could be affected?

The Deutsche Bank forecast also included a few inventory predictions. They’re saying investors should buy Boral [ASX:BLD], hold CSR [ASX:CSR] buy Fletcher Building [ASX:FBU], hold Adelaide Brighton [ASX:ABC], buy James Hardie [ASX:JHX], hold GWA Group [ASX:GWA], and buy Brickworks [ASX:BKW]. They are saying ‘We believe Boral […] is in a powerful position to benefit from a robust housing environment given Twenty-eight per cent?of Boral sales relate to Australian housing‘.

Credit Suisse agrees with DB about Boral. They have an ‘outperform’ rating on Boral, meaning Credit Suisse think Boral will outperform their own projections.

There are lots of other stocks on the ASX that could be affected. Many of the companies on the ASX 200 Materials index and the ASX 200 Industrials index specialise in building supplies or components.

It’s important to note that not all companies that sell creating materials will be more profitable because of higher construction activity. Some might also have high expenses in other areas. For example, early this year some analysts were saying that GWA Group had a lot of brands to run, and that had been affecting their margins.

Eva Mellors,

Contributor, Money Morning

PS: Searching for ASX stocks with strong potential for growth in 2015? You won’t want to skip our editor Kris Sayce’s free statement, ‘The Five Best Performing ASX Stocks for 2015’. Inside you’ll learn:

- How rising consumer confidence could see 1 underperforming Aussie retailer bounce back in 2015

- Why a low oil price might do wonders for a certain household stock

- How one big miner could take off on the back of the recovering iron ore price

Click here to find out how to claim your free of charge copy.