Why Don’t APRA’s Investor Lending Rules Appear To Be Working?

For nearly a year now, APRA has actively been trying to get banking institutions to lower the growth rate of the lending to investors.

Towards no more last year, they set a strong target of under 10% growth.

Over the past couple of months, banks make moves to reduce investor credit growth. Or so they said. A few banks changed the ‘stress test’ installed applicants through, raising the hypothetical interest rate they evaluate their incomes to. Others removed the special deals these people offered to investors. Deals for example interest rate discounts, fee-free applications, and so forth.

But on first glance, it doesn’t seem to have worked.

Yesterday, APRA put out its latest month-to-month banking statistics.

They showed that the total value of investor mortgage debt has grown by nearly $4.Sixty five billion in the last month. It’s gone from $474,076,000,000 to $478,725,000,000.

This period last year, it was $430,584,000,000.

That means it’s grown by 11.2% over the year.

But that doesn’t necessarily mean that APRA’s pressure is not working. Or that banking institutions aren’t trying to slow buyer credit growth.

The other things that may be happening

The numbers need to catch up with the actual banks’ changes

It might take a while for investor lending numbers to catch up with the changes that banks have made. Most of the big banks have only made changes, like getting rid of investor discounts, for a couple of months. If they’d been attempting to slow investor lending since May last year, then the 11.2% figure would be a fair measure of how poorly they’re doing. But it’s not. It could take several much more months to see if the buyer mortgage stats change.

?There’s a different number of banks making up APRA’s stats

In May 2014, there were 71 banking institutions on APRA’s list.

In May 2015, there were 73 banks on the list.

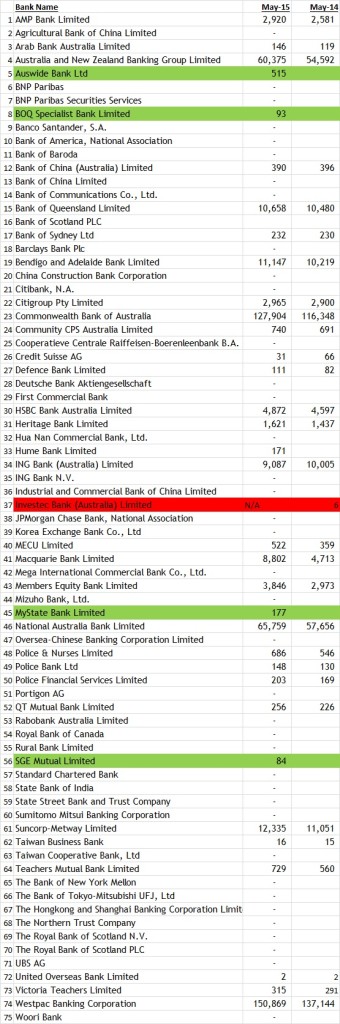

In the actual chart below, the green featuring shows banks that had buyer mortgages in May 2015, but not in May 2014. Either because they didn’t exist, because they weren’t officially banks before, or even because they only recently started offering investor mortgages. For instance, Auswide Bank was just launched at the beginning of April this year, but it’s made up of building societies that have been around for several decades.

Note: figure Equals millions of dollars. So 1 Equals $1 million.

Data source: APRA

[Click to enlarge]

Only 1 bank that did have buyer mortgages on its books in May 2014, didn’t have all of them in 2015. That’s Investec Bank, which got bought by Bank of Queensland and renamed BOQ Specialist. The other bank which made up the numbers was Bank of Scotland, which did not have investor mortgages either period.

So if you take away the $6 million from Investec that became BOQ specialist, there’s still $863 million of new bank investor mortgages that’s new between the two sets of statistics.

If you take that out of the formula, investor lending only increased by 10.9%. That’s a little closer to APRA’s target.

Some banks are worse than others

If you look in the chart above, some banks have grown their year-on-year investor lending a lot more than others. For example, NAB’s increased by 14.05%. And Macquarie’s increased by 86.7%. And ANZ’s increased by 10.6%. In some cases, smaller banks were worse culprits. For example, ME Bank’s investor lending grew by 29.4%.

Fewer people are investing, but those that do are buying more expensive properties

It’s important to remember that APRA’s stats are for the total value of investor home loans. Not the individual number of properties.

So it’s possible that fewer individuals are investing. But maybe the ones that do are buying more expensive investment properties.

There’s two reasons behind this. First, average house prices have gone up a lot over the past year. The same properties cost more this May than they did within May last year. So anyone wanting to break into the market, or add to their portfolio, will be paying more. Banks could be making the same number of buyer deals — or even fewer — and still ending up with a higher amount of money on their books.

Second, investors may be looking to a different type of property. One that is more expensive now, but they believe has more capital growth potential. Some experts say that there are too many flats coming on the market, and it’s slowing down the price growth. Others point out that supply of houses in desirable suburbs is strictly limited, although apartments could theoretically maintain getting built higher and denser.

For example, look at the inner Melbourne suburb of Carlton. According to the REIV, home prices have gone up 15.7% over the last quarter. But unit prices have gone down 13.6% in the same time. Carlton is close to the University of Victoria, so it’s home to a lot of small apartments built for students. Or even look one suburb to the eastern of Carlton, to Fitzroy. House costs grew 4.7% last 1 / 4, but unit prices shrunk 10.1%.

Of course, apartment prices aren’t shrinking everywhere. They’re still growing in the hottest Sydney suburbs. But in the majority of the growth areas popular with traders, house prices grow significantly faster than apartment costs.

Some investors also prefer homes because they feel there’s much more freedom to make changes and enhancements, without a body corporate letting them know what to do.

Investors are ramping upward their portfolio growth

Some investors just want one investment property. They may plan to pay it off slowly, and employ the rental income to fund their retirement.

But lots of investors want to grow their property portfolios as quickly as possible. Their aim is to be asset rich, and also for their leasing income to eventually substitute their salary.

To grow their profile as quick as possible, an investor can do a couple of different things. 1, they can save up another down payment to buy another property. For the way expensive that other rentals are, it could take them a few years.

Two, they are able to use the equity from their very first investment property to take out a mortgage on a second investment home. This is a popular tool with regard to fast portfolio growth. No doubt you’ve seen the ads and headlines; things like ‘23 year old builds 6-property $2.3 million property portfolio in one year!‘ What most of them fail to mention is that they obtained their first deposit from their parents. Or their parents went guarantor so they didn’t have to pay a deposit. But I digress.

Many property investment spruikers point out that as long as there is a job that covers the space between the total rent and also the total mortgage repayments, you’ll be good. But if you lose your income and default, it sets off a chain reaction, and you could lose multiple properties at once.

The problem is, it’s difficult to tell whether rabid portfolio growth is skewing APRA’s monthly figures. There isn’t much data on new, first-time-investor mortgages. There’s data from the ABS around the total value of new expense housing commitments. There’s data from APRA on the total dollar value of investor mortgages.

But it’s difficult to tell how much of that buck value is individual investors adding new properties for their portfolio.

So the dollar value of investor mortgages might be going up, but the banks might not be bringing in any new individual traders.

How you can stay above the fray

If you need to invest in property, but not always in housing, there is an option. You can invest in commercial property instead. And you don’t need the multi-million dollar loan to do it. In the report ‘Three Best Investments In Australia For 2015 And Beyond’, Kris Sayce shows you exactly how it’s done. He actually suggests a few stocks you can look at to get you started. Read this report and you’ll also discover two other kinds of investments which Kris believes could dramatically grow your wealth all through this year. Click here to find out how you can download your free duplicate of this report.

Eva Mellors,

Contributor, Money Morning