Investors Can’t Ignore This Worrying New Trend

There has been a stunning rally within US stock prices.

The US S&P 500 index is up 12.5% since the September low.

Thats a good thing, right?

Everyone wants stocks to go up.

Thats true. In a way. But not things are as clear as it appears.

Its great when stocks go upbut only if its for the right reason. And right now, stocks arent going up for the right reason.

That makes this rally a dangerous rally. Well explain why

As weve explained many times before, two things move stock prices: earnings and rates of interest.

Everything in the market stems from that.

In an ideal world, you should be able to look at a particular company and forecast its earnings potential. At the same time, you should be able to forecast future interest rate levels.

You could connect those numbers into a fundamental spreadsheet, and it would give you a good idea about the value of a regular.

But its not a perfect world. A person cant just look at company earnings. And its almost impossible to predict long term interest rate levels.

But investors arent basing buying decisions on future earnings or interest rates. Theyre basing their buying decisions on what they think the US Federal Reserve will do next.

Thats what makes this current stock rally so harmful. Because if the Fed says something the market doesnt like, stock prices can soon shift the other way

Confusion from latest market action

For evidence, take this headline through Bloomberg, Yellen Rate Remarks Halt U.S. Stock Rally as Dollar Strengthens.

The Dow Jones Commercial Average closed down 0.28%. The S&P 500 catalog closed down 0.35%.

It doesnt consider much to move the market these days.

However, heres something that muddies the waters.

The marketplace fell last night, supposedly on the prospect of a US interest rate rise in December.

But, heres an example of traders reacting one way one day, and the other way another day.

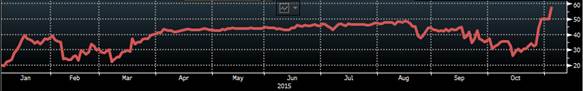

Below is a chart showing the probability of a US rate of interest change at the December meeting:

Source: Bloomberg

The probability of an interest rate change has climbed from below 30% within mid-October to 58% today.

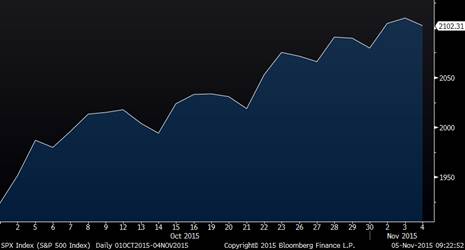

And what has happened to US stocks over the same timeframe? Check out this chart:

Source: Bloomberg

The S&P 500 index has continued to climb.

This may all sound confusing. How can stocks fall upon news of a potential rate of interest rise after spending the previous fourteen days risingon the potential for an interest rate rise?

It all comes down to different investor perceptionand a dose of reality for which an interest rate rise would really imply.

Investors cant look past this chart

Most people think that stock markets fall as soon as a central bank begins raising interest rates.

The reality is frequently different. In most instances, stock prices rise. Thats because the central bank is actually raising interest rates due to a booming economy and a stock market thats already rising.

In that scenario, traders are willing to look past the higher cost to service debt because they figure businesses can still grow income and profits.

But heres a chart that should have bullish investors at least pausing for believed, if not outright ducking for cover:

Source: Bloomberg

The graph shows actual earnings per share with regard to stocks in the S&P Five hundred index. The chart dates back to 2006.

What should difficulty investors the most is what seems to be a new downward trend with regard to earnings. Its a reasonably subtle alternation in the trend, but its definitely presently there.

In the past investors were pleased to overlook rate rises due to growing earnings. But based on this chart, if traders try to look past an interest rate rise, they wont see rising earnings. Theyll see lower earnings.

Will traders and traders still be therefore keen to buy stocks?

Well see.

Regards,

Kris