What You Need to Know: How Bonds Work…

Yesterday the S&P/ASX 200 index was up 98.5 points. Thats a 2% gain.

European stocks acquired too.

The FTSE 100 index closed trading up 2.8%.

The gains carried through to US trading, where the Dow Jones Industrial Average gained 1.9%, or even 304 points.

Has the world averted another crisis?

Is the worst over? Or is this just the newest false dawn for the markets before the last crash begins?

One of the things we enjoy most about the markets is the accidental positioning of news tales particularly in recent years.

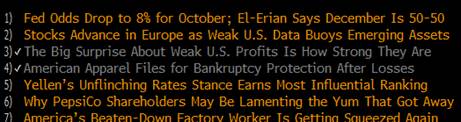

Take this screen shot from Bloomberg:

Its a great contrast.

One news item screeches about the strength people company earnings. Meanwhile, the story below it reports on the collapse of retailer, American Clothing [NYSE:APP].

Its no wonder the company collapsed. It features a market capitalisation of US$20 miland more than US$200 mil in outstanding debt.

Even reduced rates couldnt save this business

It just goes to show that even record low interest rates cant help every business.

Even with report low interest rates, American Apparels annual interest costs have increased from US$11.Eight mil in 2006, to US$39.9 mil this year.

As usually, the best way to show the performance and the success of a organization and its stock, is to look at the price chart. Here it is:

Source: Bloomberg

The inventory is down 98.5% because 2006.

After peaking above US$15 in 2007, it last traded upon Friday at 11.2 cents.

But this isnt just about a middle-of-the-road retailer.

That companys debt position is definitely an example of whats happening right across corporate America. Its why weve said to closely watch the yields on junk bonds.

To measure individuals yields, we follow the SPDR Barclays Higher Yield Bond ETF [NYSE:JNK]. Its an ETF that holds higher yielding, non-investment grade bonds.

Today, the yield on this ETF is 6.27%. One month ago, it was 6.1%. One year ago, it was 5.83%.

This is how bonds work

While the actual yield on a bond ETF may not seem important, it gives you a peek inside the mind of investors.

In order to understand why, well give you a quick lesson in Ties 101.

Bond prices and bond yields move inversely. The easiest way to explain this is to use a bond that matures in one year having a face value of $100, and an rate of interest of 5%.

When you buy a relationship, youre lending money. So, if you lend $100 when buying a bond in this example, youre expectation is the fact that youll get your $100 back one year from now. In return for lending the $100 you also expect to receive a few compensation for it. In this case, youll receive a coupon (interest rate) of 5%.

In short, following one year, youll have made $5 on the $100 a person loaned, plus youll get your $100 back again.

OK, thats simple. But now lets include an additional variable. Lets say that the bond you bought is tradeable. Now lets say that other investors like that bond, simply because they see it as a safe wager. So, they decide that theyd prefer to buy it from you a month after you bought it. But because they see it as a safe bet, theyre happy to pay more for it compared to you paid.

In this instance, theyre happy to buy it from you with regard to $101. Why would they do that, although the face value is just $100? Since they know theyll also receive the $5 discount.

So, at the end of the year, theyll receive $100 back from the company, as payment of the bond (loan), plus theyll have earned the $5 coupon. They lose $1 on the bond, but gain $5 on the discount, leaving them $4 better off.

For the customer, the yield theyll get from the investment is only 4.9%. Remember, these people paid $101 in order to make get that $5 discount. And their total return around the investment is only 3.9%. Once again, because they paid a higher cost for a fixed return.

For your part, sure, you didnt get to get the $5 coupon, but you sold the text for $1 more than you bought itand you probably did so just a month after buying the bond. On an annualised basis, thats not necessarily a bad return.

However, what happens if lot of money swings the other way?

When things go wrong

As with any investment, theres always a downside.

Lets say you buy the bond for $100 face value, but several weeks later the company that issue the text reports a big loss and investors start worrying about the way forward for the business.

In that case, youve got $100 on the line. The bond doesnt mature until the end of the season, and you wont get the coupon for now either.

Youre worried. What if the company goes bust? What if the organization is unable to repay the loan, let alone the coupon?

In this case, you go to the market to see how much other investors are prepared to pay. Simply because they know the same information as you, theyre unlikely to pay the full face value.

In fact, because of the risks of buying this bond, additional investors are now only ready to pay $60 for the bond with a $100 face value. You have a option: risk losing everything, or at least get back 60% of your investment.

You take the latter choice. Youre out. But what about the new owner of the text? Well, theyre taking a calculated risk. Theyre betting that either the organization will be able to meet its financial debt obligations, or that if the company goes bust and is broken up or sold off, that theyll still make back more than their $60 investment.

Thats because bond holders spend time at the front of the queue when companies go bust.

If the company comes through and repays the bond at face value, and pays the coupon, the new owner will cash in the text to receive $100, plus theyll get the $5 couponall for making a $60 bet.

In terms of the impact that has on the investors returns, in effect theyre getting an 8.3% yield ($5 on the $60 investment), but the general return is around 57%, once they cash in the bond at face value.

Theres no new way to go broke

Perhaps you can see why its important to watch these junk bond yields.

If companies can continue to meet their financial debt obligations, then everything is going to be fine. Investors who bought from a panic will have lost, however investors who bought opportunistically may have gained.

But what if companies cant repay their debts?

The fact that the produces on junk bonds have risen by half a portion point over the past year is significant. It shows that investors are worried about the ability of a few companies to repay debts.

If companies are struggling to pay back loans when interest rates are at record lows, it just goes to show there are many much more problems with the worlds economy than most people think.

As our old buddy Vern Gowdie often says, There isn’t any new way to go broke. Hes right, its the same way every time too much debt.

Cheers,

Kris

PS: Vern explains all this in great detail in his new guide, The End of Australia. Weve already imprinted and posted more than Sixteen,000 copies, but we cant keep printing them permanently. Go here to find out how to claim your copy now.