How to Profit from the Currency Wars

On 14th January this year, one of the greatest battles in the long running worldwide currency wars broke out.

It took most investors by surprise.

And for many investors, not only made it happen take them by surprise, but it ended up costing them millions, and perhaps, billions of dollars in losses.

That event, that major battle, was when the Swiss National Bank ended its peg to the euro in January this season.

The Swiss had maintained a peg to the euro for three many years. Why would they do that? It had been all due to the European Main Banks (ECB) policy of devaluing the dinar through money printing.

The ECB desired to devalue the euro in order to help boost exports. Its the same reason why the US wanted to devalue the united states dollar by printing more.

The trouble for Switzerland is that a devalued euro would mean an increase in value for the Swiss franc. The Swiss feared that would result in a drop in exports and harm the Swiss economy.

So the SNB pegged the actual Swiss franc to the euro. This meant that as the ECB printed pounds to devalue its currency, the SNB would have to actively sell Swiss francs in the foreign exchange market, to push down the value of the franc.

That too would involve printing money.

But suddenly, in The month of january this year, the SNB gave up. The actual ECB announced that it planned to open up a new money printing program, and the SNB realised it simply couldnt keep pace.

So they decided to unpeg the Swiss franc from the dinar. The impact on the currency markets had been huge. As Business Insider reported at that time:

Hedge fund manager Marko Dimitrijevic is shutting his largest hedge account, Everest Capitals Global Fund, having lost almost all its money following the Swiss National Bank (SNB) scrapped its three-year-old cap on the Swiss franc against eh euro, Bloomberg news documented on Saturday.

Citing a person acquainted with the firm, Bloomberg said the actual fund had been betting that the Swiss franc would decline. The actual fund had about $US830 million in asset at the end of 2014, according to a client report cited by Bloomberg.

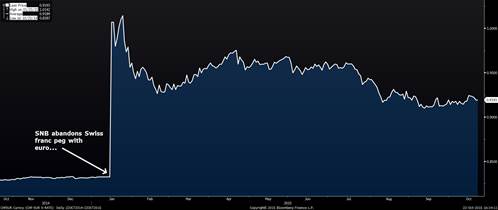

The chart below gives you an idea to when the SNB abandoned the peg. See if you can spot it

Source: Bloomberg

The Swiss franc appreciated by 23% over the euro within 24 hours.

It was a stunning move. As the report above illustrates, some funds lost a bundle on it.

But, not everyone lost. There were plenty of savvy investors as well as institutions that made a eliminating on the SNB move.

As Fortune noted simply two weeks later:

Banks are finding their own way around the Volcker Rule in some unexpected ways. JPMorgans recent windfall off the Swiss franc and Citis loss is testament to that fact.

Earlier this month, traders at the nations biggest financial institution made $300 million in one day time, following news that the Switzerland central bank was taking its cap off the franc. Which caused the currency in order to soar, and JPMorgan traders took the move, literally, to the bank.

Why did the Switzerland franc move this way? Because of the global currency wars.

Now, events of this particular extreme nature are abnormal. They dont happen all the time. However other events, mostly of a smaller nature, do happenand these people happen more often than you may think.

And not only to the currency markets either.

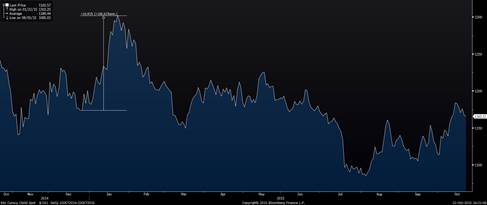

Look in the following chart. Its of the precious metal price in US dollars.

From past due December to mid-January, it moved nearly 11%.

Source: Bloomberg

Why did gold proceed ballistic like this? Because of the global currency wars.

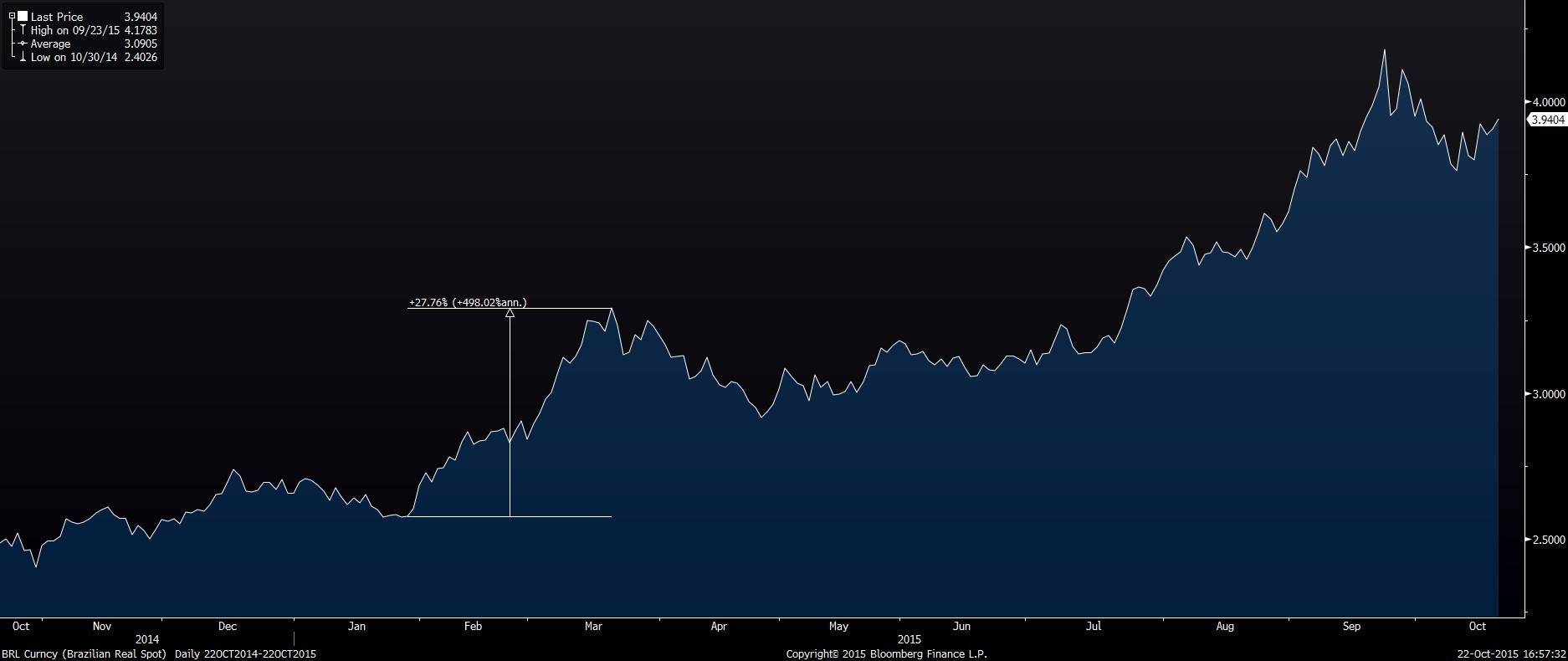

Cop a look at another graph, this time of the Brazilian actual. It moved 27.8% in only two months:

Source: Bloomberg

Why did this occur? Because of the global currency conflicts.

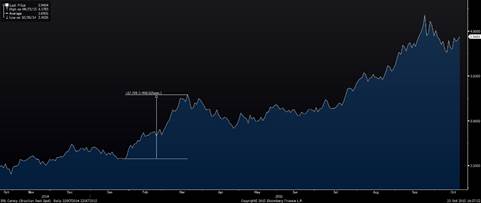

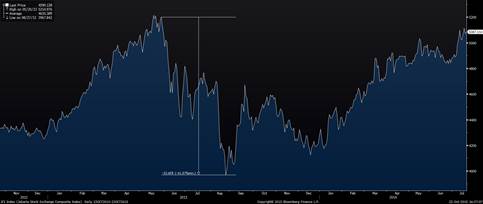

From March to April this year, Brazils IBovespa index gained 20.2%.

Source: Bloomberg

Why did it do that? Because of the global currency wars.

In 2013, Indonesias main stock index fell 23.6% within three months. Why? Because of the global currency wars.

Source: Bloomberg

Look at any of the charts Ive shown you and youll see big price movements more than relatively short periods of time. A number of these are a result of the global currency wars.

Its these price movements, related to the currency wars, which were targeting with a brand new trading consultant, Currency Wars Trader.

Just note one thing. Even if this service aims to help folks profit from (or protect their own wealth from) the global currency wars, it doesnt involve forex trading.

This new service aims to help investors and traders profit from the actual currency wars without actually trading in currencies themselves.

Its a distinctive trading service. It doesnt involve technical analysis. And if you so choose, it doesnt have to involve leverage either (although if you want to sensibly employ influence, well show you how).

And its not fundamental analysis in the traditional method either. Our strategist and experts arent looking at company balance sheets and profit and loss statements as youd expect.

This is what I call macro-fundamental analysis. Its exploring the big economic news and events, looking for hidden triggers within the market, using our strategists unique approach.

After the strategist offers identified these triggers and signals, its then up to the analysts to apply that to some specific investment idea.

That calls for buying or selling a particular type of investment that they believe is best positioned to profit the most from an expected move.

Its sure to be controversial. This is a strategy that until now has been unavailable to the ordinary investor. But now, as the global currency wars gain maintain, and have an ever greater influence on the markets, its only right that we make this strategy available to you now.

Cheers,

Kris