An Investment Strategy You Can’t Refuse

‘Then and now’ comparisons are fascinating.

I’m constantly amazed to see how times change — or don’t change. It could be a city skyline, or community values. No matter what the setting, the contrast is always interesting.

A few years back, I tracked down an original picture of my house. The picture dates back to 1906 — the year of construction.

I’ll never forget seeing the picture for the first time. Yes, it was my house — the windows, chimneys, as well as gables were unmistakable. But the setting was unrecognisable.

The photo shows the initial family standing in front of their new home. You can see buggy monitors in the then dirt road, and a long forgotten adjoining house sitting to the side.

It was like seeing an old buddy, but with a completely different existence to what you knew.

Images such as this captivate me. I imagine the period of the original photo. I wonder what the people were thinking. I’m wondering what it would have been like to be there on that day.

Pictures are just one way to help to make comparisons. Another contrast is to look back at statements concerning the future. Some are hopelessly wrong. But others get close to the mark.

Have a read of those next few paragraphs…

‘Imagine the coin toss…but one where you’re playing with a Packed COIN.

‘In other words: a gold coin that falls in your favour more often than not. Meaning the average winning payout is not 1-to-1…but 2.5-to-1. You have a $2.50 payout for a win…but only stand to shed a dollar if you lose.

‘Let me personally ask you: would YOU be keen to play? I don’t know about you, but I’d line up around the block to play which game ALL DAY LONG.

‘This is the Quant Trader advantage.

‘This 2.5-1 loaded coin is very similar to Quant Trader’s back-tested results over time.

‘When you average 38.5% with regard to winners and only 17% for nonwinners, you can do very well in the long run having a 53.4% strike rate. The typical hypothetical payout rate has been 2.59-to-1.

‘Are you beginning to see the clear and present advantage of this kind of trading?

‘It’s a bit like becoming told that there’s a certain live roulette wheel in the corner of the on line casino that’s got ten more black numbers than red figures.

‘Statistically, it’s telling you that, with time, you can’t help but make a lot of cash!‘

Quant Trader email — 15 November 2014

This is part of the original promotion for Quant Trader. This appeared a few days before reside signals began. All the outcomes at that stage were from back-testing.

I make use of back-testing all the time. It’s the best way I understand to test how a strategy is prone to perform in the future.

The idea at the rear of back-testing is simple. We want to test if your system worked consistently previously. If it does, then there’s valid reason to believe it will continue to function.

Back-testing doesn’t provide certainty. However it does indicate if a technique has merit. It’s one of the great advantages of system trading. It can save years of learning from mistakes.

Proof is in the pudding

So how does the back-testing compare 12 months later?

First, here are the performance numbers from back-testing. Fundamental essentials ones in the excerpt above. This is our ‘then’ period…

| Average profit |

38.5% |

| Average loss |

-17% |

| Percentage of winning trades |

53.4% |

| Payout ratio (dollars won for any dollar lost) |

2.59:1 |

These are good numbers. The question is whether real life can live up to the past.

Okay, let’s wait and watch what ‘now’ looks like…

| Average profit (just about all open & closed trades) |

29.0% |

| Average loss (all open & closed deals) |

-13.5% |

| Percentage of winning trades |

51.3% |

| Payout ratio (dollars won for a dollar misplaced) |

2.26:1 |

(As of 25 November 2015)

This is a great result. The live signals are in line with the back-testing. The system is doing exactly what it is supposed to do.

Now, let me clarify a few things about these numbers. The first table shows the outcomes of all closed trades. It covers the period from 1 January 1993 to 31 October 2014.

The second table is from 17 November 2014, the day reside signals began. It includes just about all open and closed trades. I’m including open trades as they currently make up the majority of signals.

You’ll notice the average revenue is lower for live signals. This is partly because many positions are still open. Some may move a lot additional. This would increase the average over time.

I also expect the average reduction will ultimately rise. The numbers from back-testing include a number of big bear markets. The future will also have its share of downturns.

But differences aside, the live indicators are meeting the standard set in testing.

Betting with the odds

I have 2 charts to show you. The first is the All Ordinaries…

This is what the last Twelve months looks like. It hasn’t been a classic year by any means.

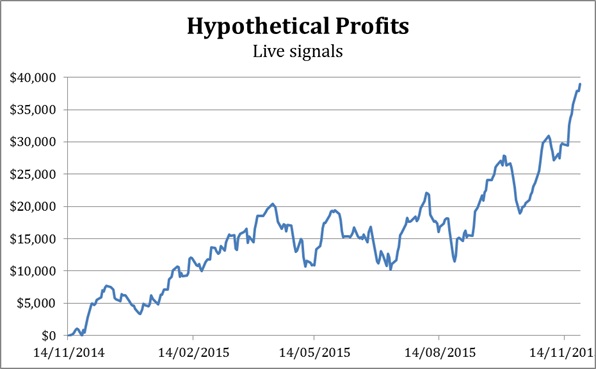

Now let me show you how Quant Trader‘s trades are tracking…

As much as I like statistic, nothing can beat a good graph.

The chart exhibits Quant Trader‘s hypothetical profits over the same time. As always, there is no allocation for costs and dividends. It also assumes $1,000 upon every signal.

Quant Trader doesn’t get this right every time. In fact, close to half the trades have historically lost money. And that’s okay. It’s part of the strategy.

The aim is to trade stocks which meet the selection criteria. We then let the good trades operate, and cut the ones that don’t. That’s how the system makes money.

Quant Trader doesn’t offer certainty — I don’t know any method that will. There’ll be times when the indicators fail. That’s the reality of trading.

But I do know this. It’s a system with a long and consistent track record. That’s the easiest way I know to put the odds inside your favour.

Until next week,

Jason McIntosh,

Editor, Quant Trader

Editor’s note: Did any of your stocks strike new high this week? Chances are the answer is no. And that’s understandable…the All Ordinaries is still displaying a loss for the year. But some stocks are surging. They could create a big difference to your portfolio.

Take HUB24 Limited [ASX:HUB] for instance. You’ve probably never heard about this stock, but a week ago it hit a 4 and a half year high. And that is good for Quant Trader’s members. You see, Quant Trader has signalled this stock three times since July. The signals are now up 134%, 95%, and 62% respectively.

Anyone could possibly get gains like these. It’s all about having the right strategies. You can learn more about these here. Look for Jason’s article. The title is ‘It’s an Eagle’s World’.