This Simple Test Could Save You Thousands

How much insurance cover do you have?

I did a stocktake over the weekend. It turns out my loved ones has nine policies. You can include an extra couple if you consist of indirect cover.

Our insurance addresses everything from home to business…life to health. There’s something for everybody.

This level of cover doesn’t arrive cheap. The combined cost is thousands of dollars annually.

Some may state this is over the top. They could dispute the odds of the sky falling in are low. And they’d be right. The worst outcome rarely happens.

But sometimes the longshot gets up. This is where insurance pays its way.

You can insure just about anything these days. The key is deciding how far to go.

I have a strategy for making this decision. I call it the ‘what if’ test.

This is how it works. I ask myself what if the most detrimental was to happen. If I am prepared to live with the monetary outcome, I do nothing. But if not, then I insure. It’s as simple as that.

Let me provide you with an example.

Insuring a six figure bonus

Investment banks have a reputation for paying big bonuses. My former company — Bankers Trust — was no exclusion. Six figure bonuses were common. Some were higher still.

My most profitable year in the bank was 1998. A number trades had done very well. And I was on track for the greatest bonus of my career.

But there was a problem.

The markets had been on edge. An economic crisis was unfolding in Russia. Also it was sending shockwaves around the world. There was a real fear stock markets could fall hard.

Rumours had been circulating that my company was in financial trouble. A number of big bets on rising markets had gone south. There is a sense that the bank might not see out the year.

The collapse of a high profile hedge account didn’t help. This place extra pressure on a unstable situation. My concern had been the bank would go under when the markets sold off. That would be end of my bonus.

Insurance companies will give you cover for many things. Regrettably, bonus cover is not one of them. I had to tailor my own insurance package.

So I got creative. I purchased put options on high priced stocks. The logic was that if the markets crashed, my personal put options would rise in value — and cover the likely loss of my bonus.

It was an imperfect hedge. However it was better than nothing. For a few thousand dollars, I had a lot of safety if stocks took a dive.

Well, a crash didn’t eventuate. Bankers Trust made it through the 12 months. And I got my bonus.

The options were a write-off…they run out worthless. But that’s okay. It is a good year when you don’t need a payout on your insurance.

But my fears were real. My employer didn’t last considerably longer. Deutsche Bank took it over the following year.

Insurance is a key technique for managing risk. It’s your backstop for when things don’t go to plan.

Quant Trader offers two inbuilt insurance mechanisms. The first is the exit stop. Think of this as basic cover. It gets you out when a inventory falls. The money you shed is effectively your insurance coverage excess.

The next level of cover is more exotic…and it isn’t for everyone. This is short selling. The aim is to make money once the market falls. This should act as a buffer for losses on long trades.

The figures that count

Last week you saw the performance of long trades. Now I’ll consider the shorts. This will give you a obvious picture of how Quant Trader‘s insurance strategy is tracking.

But first, have a look at the next chart. It’s the All Ordinaries over the period Quant Trader has been giving live signals…

There are three distinct periods:

- Stocks sell-off into mid December

- There is a strong rally into the April high

- A five month (and keeping track of) correction kicks in

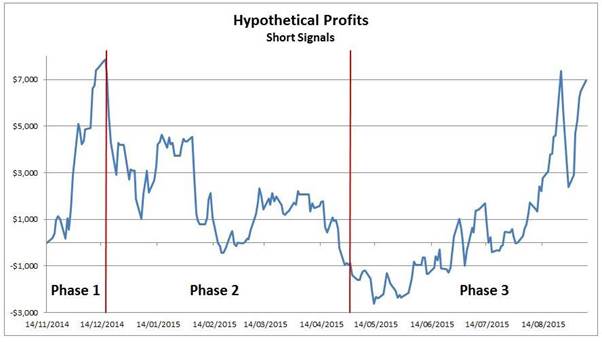

Now check out the overall performance of Quant Trader‘s short trades.

>

>

This exhibits the hypothetical performance associated with Quant Trader‘s short signals. It assumes $1,000 on every short signal. There is no allowance for costs.

Again, you can see the three periods. The insurance policies are working hard in periods 1 and 3. This requires the pressure off losses through long trades.

Period 2 shows a loss. This is when the market is actually rallying. Shorts will typically be considered a drag on performance during these occasions. That’s the price of insurance.

Let me say that Quant Trader is not a standalone technique for trading short. The system makes most of its profit via buying shares. So don’t be concerned if you’re not comfortable with shorts.

But shorting is a worthwhile strategy for some investors. It takes the edge off lower periods. This tends to smooth out performance over time.

Most people insure their own car and house. A sizable majority also have private health cover. But fewer people think about cover for their share portfolios.

Insurance isn’t a free ride. I’ve paid much more within premiums than I’ve collected over the years. And that’s a good thing. Insurance coverage is a plan for the worst. It’s something I hope not to call upon.

Until next week,

By Jason McIntosh

Editor, Quant Trader

Editor’s note: If you don’t understand which stocks to brief, then Quant Trader can help. The system’s algorithms are constantly scanning the marketplace for vulnerable stocks. It will then issue a sell sign, and calculate a unique stop-loss.

Just a few days ago, Quant Trader identified a high profile chance. This stock was a shining star of the bull marketplace. Its shares soared by over 300%. But now the trend is gloomier. This market heavyweight has potentially a long way to fall. There is still time to get short…but hurry.

You can learn more about Quant Trader here.