China’s Economic Slowdown Is Nothing Compared to This

I want you to take a speculate…a simple guess.

The pictures below are taken from China’s largest ecommerce platform, Taobao.com. It is operated by Alibaba [NYSE:BABA].

These pictures are all showing one type of consumer product. I want you to consider a guess at what it’s.

And here is a clue: it is a life-saving device.

|

| [Click to open in new window] |

|

| [Click to open in new window] |

|

| [Click to open within new window] |

If you said anything other than ‘air purifier’, you were wrong.

This 7 days, Beijing officially issued its first smog ‘Red Alert’ in history. At times ago, Beijing experienced a few very severe smog conditions, which received a ‘Yellow Alert’.

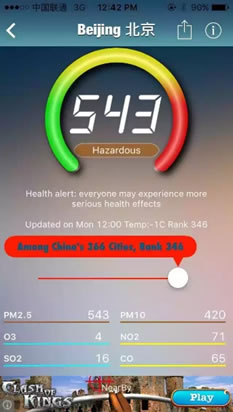

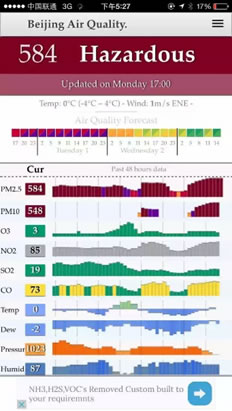

During the Yellow Alert, visibility dropped to below 100 meters. Air quality dropped to…well, why not take a look for yourself?

I saved a few images from my friends’ articles on Wechat in Beijing in this yellow alert. Wechat is China’s leading social networking app, operated by Tencent [HK:0700].

Here are those ‘beautiful’ pictures.

Top-left: Beijing CBD skyline; Top-right: People dancing within the Beijing Olympic Park; Down: In the shopping mall

From left to right: various apps reporting the quality of air index in Beijing, the last one is placed inside a room.

During this Yellow Alert, Xi Jinping happened to be attending the Paris environment summit. Below is a screen shot of a CNBC headline on that day.

Other head lines in that week included: ‘Airpocalpyse within Beijing as Xi touts a greener China’, ‘Is this the end with regard to coal?’ and ‘Bill Entrance to launch massive clean technology initiative’.

There is no choice this time

My stage is extremely simple. China, the biggest greenhouse emitter in the world, is at the end of its rope when it comes to pollution.

I am not even talking about global warming on a global scale. A lot of people don’t buy the climate change argument and the scientific numbers behind the argument remain debatable.

However, while climate change can wait, people can’t wait for climate. What matters to people at the end of the day is that they and their children need to be able to breathe.

And in China, they can’t…

What does which means that for China — a country that is going to be 25% bigger than the US economy in five years on a Purchasing Power Parity basis?

For one, it means social unrest at the existing level of pollution. Secondly, it means massive health effects associated with lungs and throats, particularly for young children and also the elderly. The negative health effects will undoubtedly become more pronounced in the next few years.

But that’s not all. Additionally, it means MORE social unrest In the event that Beijing is not seen doing anything about this challenge.

I would like you to take this in for a moment. How would you feel if you are choking on air and there is absolutely nothing you can do to stop it?

Pretty depressed, indeed? That’s exactly how my friends really feel in Beijing. I know since i asked them.

Recently, the Chinese yuan was inducted into the IMF SDR (Special Drawing Right). This was another nod around the rising financial and politics power of China in the world.

In the actual Mao era during ‘The Great Leap’, the actual slogan of the day was ‘to surpass Britain and to catch up with America‘.

‘The Great Leap’ was Mao’s economic experiment. This ended in massive famines and numerous deaths.

But today, the ‘dream’ is finally coming true with regard to Chinese nationalism.

However, it has come at a price. A cost all too high for everybody.

This is the turning point

On the surface, the smog Armageddon in China dwarves the economic slowdown concerns. However, the two actually stem from the same single problem — a lack of environmentally friendly development.

You have heard about China’s rebalancing from manufacturing and exports to providers and consumption.

In terms of totally free market economics, that makes perfect sense. As China’s secondary industries reach a point of gross overcapacity, it brings about a deflation in commodities along with a slowdown in economic actions.

The other side of the coin is the sustainability dimension. People have typically overlooked this dimension in financial and economic analysis.

But as the social and political costs of unsustainable development increase, even an authoritarian government like Beijing has to create a U-turn if it wants to stay in power.

It has to change its power mix to increase renewable energy and clean energy; it has to reduce the use of fossil-fuel based energy sources.

And The far east is doing that.

In my Eighty three page travel journal, ‘The Actual China Revealed, The Insider’s Help guide to the King of Emerging Markets’, I interviewed fund supervisors and brokers on their look at the sustainability issue within China. I also interviewed the actual CEO of a synthetic leather maker, which is identified as a major harming industry.

The revelations were consistent with the state plans from the NDRC (National Development and Reform Commission). China is spearheading towards a far more sustainable growth model.

Investment angle

Right right now, we have a willing US and a desperate China. We also have an unwilling India.

What about fossil fuel, you may ask. No, fossil fuel is not going to be phased out in the near future. It powers more than 60% associated with China’s energy and it powers regarding 70% of India’s energy need.

But the growth of clean energy technology, as well as renewable, clean and nuclear powers are going to pick up.

That also means eco-friendly investing is going to come back. As investors, you need to be looking into this area.

Ken Wangdong,

Emerging Markets Analyst, New Frontier Investor

From the Port Phillip Posting Library

Special Report: If you want to get ahead nowadays, it pays to have powerful buddies in high places. With this particular new advisory, you’ll make one. A portfolio manager at the Western Shore Group, and adviser on international economics as well as financial threats to the All of us Department of Defense. Jim Rickards is no regular financial newsletter writer.?And Strategic Intelligence is no ordinary newsletter… (more)