What Does Our Resources Expert Think About Gold Stocks?

At what point does a crash quit being a crash and become an opportunity?

That’s the conversation your editor had with Diggers and Drillers resources analyst Jason Stevenson yesterday afternoon.

But we weren’t talking about any old accident.

We were talking about one of the biggest crashes of history three years.

That’s right, gold and gold stocks.

We wanted to know Jason’s take on whether now was the right time to buy…

Let’s look at the proof.

First, the overall position of item prices. This week the Reserve Bank of Australia released the latest Index of Item prices. It’s not a pretty picture for mining companies.

Source: Reserve Bank of Australia

Click to enlarge

There’utes no doubt the index associated with commodity prices looks amazingly like the price chart of most asset bubbles.

It has the initial rise, the sell-off, followed by the recovery as investors assume the worst is over, and finally the beginning of the real crash.

If most other asset pockets are anything to go by, item prices could have much further to visit. But what about gold and precious metal stocks? Well, if you think the above chart looks bad, simply wait until you see these subsequent charts…

The Big Bubble That Never Quite Happened

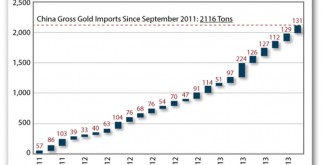

We’re sure you remember once the gold price hit US$1,921 in September 2011. It seemed that a rise to US$2,000 and above had been inevitable.

We’ll admit that we think it is inevitable. We thought it may be the big one…gold would soon trade at US$2,000 then US$3,000 and perhaps even US$5,000.

But that never happened. In fact, gold proceeded to go the other way. This morning it’utes trading at US$1,221. As we said at the start of this year, even though we’re still happy to buy gold, the great precious metal bull market is on maintain for now.

How long it will stay on hold is anyone’s guess. Just about all we know is that the worst won’t be over until even the biggest gold market bulls have finally given up. At that point the next phase of the gold bull market will begin.

That could take months, and more likely, years.

But this isn’t just the gold price that has taken a beating. Below is a chart for the Market Vectors Gold Miners ETF [NYSE: GDX] and the Market Vectors Gold Junior Miners ETF [NYSE: GDXJ]:

Source: Google Finance

Click to enlarge

These indices have fallen 66.5% and 78.5% respectively since Sept 2011.

Over the past year, just when it seemed they couldn’capital t fall any further, they’ve defied belief and…fallen further. As an optimist on the future and on stock prices, it’s tempting to think which this is the bottom for gold stocks.

But do we have 100% conviction with that? And more importantly, does our resources analyst?

Pit-Bull v the Sober Analyst

We put the question to Jason yesterday.

You’ve got to understand that your editor is like a pit-bull yanking at the leash eager to make the most of the collapse in sources stock prices.

So it’s fortunate that we’ve got a resources expert like Jason who can have a sober and analytical approach to resource stocks. Like your editor, Jason likes the fundamentals for gold, and he likes the potential for giant gains from gold shares.

What he’s not so keen on is trying – as he put it – ‘to catch a falling knife‘ as some of these gold stocks continue to fall.

Now you may think that as contrarian investors we should plunge in to recommend these stocks. And it’s feasible Jason will do that. He’utes running the numbers on a bunch of resource stocks right now.

But remember what we’ve said prior to. Contrarian investing isn’t about doing the opposite of everyone else, it’s about getting into an opportunity simply ahead of everyone else. In other words, just before or just as the market changes direction.

Of course, you’ll never get the timing perfectly correct as a contrarian investor. Sometimes the market stops falling, but it can take months before it turns greater. That could mean locking your money for some time while you wait around.

Waiting for the ‘No-Brainer’ Day to Buy Precious metal Stocks

As it stands today gold stocks are super risky. But if you’re a speculator that may be only the kind of risk you’re happy to take. If you’re a more conservative investor, because Jason still sees some dangers that gold stocks could fall further, you may want to wait a little longer before taking a punt upon gold stocks.

Naturally, that view could change at any point over the times, weeks and months ahead.

One thing’s for sure: the mixed value of all gold shares won’t fall to zero. At some point there will be a clear no-brainer decision to buy gold shares.

We’ve written in Money Morning previously that we see the resources sector as one of the best places to earn speculative gains in 2014. As the dedicated resources analyst for that investment newsletter Diggers and Drillers Jason Stevenson is excited about the potential too.

The task now is to find the best stocks on the market, value them, and then make a decision on when to buy. That’ll be a tall order with over 1,000 resources shares on the ASX…

But it’s a challenge Jason is prepared to take.

Cheers,

Kris+

From the Port Phillip Publishing Library

Special Report: The ‘Wonder Weld’ That may Triple Your Money