What Can You Do To Protect Your Investments?

There’s nothing like a battle in the Middle East to fire in the oil price. News that Saudi Arabia launched air strikes across the Yemeni border sent the oil cost up nearly 4.5% last week.

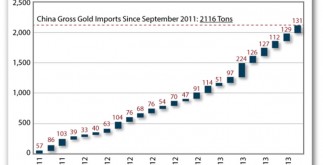

Gold had a strong reaction as well, rallying to nearly US$1,220 an ounce in London industry before retreating during the US program. Aussie dollar gold had a good session too, closing from $1,540 an ounce after falling to a low of $1,475 just a 7 days earlier.

As I’ve been stating, the US dollar gold cost that you hear quoted everyday continues to be lacklustre. But the Aussie dollar precious metal price — the price that matters for you personally if you’re investing in Aussie listed gold stocks — looks much more good.

If you want to know how to take advantage of this emerging new trend, click here.

The conflict in Yemen is another proxy battle between Iran and Saudi Arabia, following on from the tragic ordeal that is Syria. Yemen has been a failed state for some time now and has provided the actual impetus for the Iranian backed Houthis to gain a foothold of power.

The Saudi’utes aren’t happy about it; therefore, the launch of airstrikes and a large troop buildup on the border. Whether this particular escalates or dies down from here is anyone’s guess.

Regardless, under the surface there is a slow change in the balance of energy in the Middle East. Iran’s impact is rising. The Saudis are under stress. The proxy war between the two within Syria has been going for years. This really is probably the start of a similar situation in Yemen.

As an investor, is this anything you should worry about? Not immediately. But there’s no doubt the troubles in the area will continue to have a greater impact in the West.

The Syrian conflict gave rise to ISIS. Another war will just create another generation associated with young men without hope, fuelling revolutionary ideologies and violence. Great.

Is there anything you can do about it? Not really. You can be tolerant as well as understanding, non-judgemental and compassionate in your life. Good and decent behaviour comes with a flow on impact, even if you don’t see where it flows.

But wait! Our beat is money, not really morality or virtue. Therefore let’s get selfish and focus on what you can control in the world of money and materialism.

You can control your investment decisions where you get your ideas, which is why you’re reading this non-mainstream publication. You’ve clearly decided to take greater control over your money by becoming more informed as well as perhaps investing yourself.

On that front, I have something that might be of great interest to you. Over the weekend break, we launched a new support focussed on income opportunities called Total Income. You’ve heard from Editor Matt Hibbard throughout last week during these pages, but if you’re like me, you probably have a number of questions about what the service will be regarding.

With that in mind, I sat down with Matt Fri to ask a few probing questions about Total Income. We chatted for about 30 minutes. I’m a pretty erratic interviewer, so the below Q&A is an modified version.

I started by requesting a question based on an important stage that Matt raised in his very first essay, on Monday last week…

You mentioned in your first essay last week that allowing for risk [Editor’s note: making sure you don’t overpay for a stock simply to obtain the yield] is the most important thing income investors must do. But how do they do this inside a world of central bank manipulation that deliberately mis-prices risk?

What I intended by that comment was that you have to distinguish between the different types of results paying companies. It’s about putting a risk premium on cash flows — smaller, much less established dividend payers would probably be a more risky investment than a larger company by having an established record of paying out dividends. In other words, it isn’t just a straight line process of going through the cash balance, EPS (earnings per share) and dividend growth, as well as making a recommendation without taking into account the risk attached to the cash flows.

In relation to your question about main banks manipulating the risk premium, it’s true and something that all income investors need to be conscious of. But no one knows how long this state of affairs continues. It could be like this for years to come.

My technique to deal with it is to focus on asset allocation, diversification, and low levels of leverage. People need to be totally aware of the potential risks that central banks have formulated with their low rates and money publishing, even if the market isn’t adequately pricing in those risks.

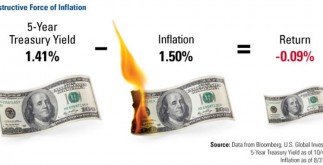

The other thing to keep an eye on is inflation…

Well that brings me to another question I had. Normally, higher inflation is good for earnings investors as it often leads to higher interest rates and dividends. However in today’s world, persistent concerns over deflation have kept interest rates reduced and asset prices high. To what extent are you concerned that rising inflation might cause a big fall in asset prices, negating the benefits of receiving an income yield?

Like many people, I’ve found it hard to believe that years of cash printing won’t lead to a rise in inflation in the future. But we haven’t seen it yet and we may not view it for years to come. We’re in uncharted territory. No one knows exactly what lies ahead. It could be years of more of the identical or something completely different. All investors can do is deal with the problems as they are.

One thing I expect to do is keep a close eye on the number of inflation statistics and offer these in the newsletter in an ‘income dashboard’, so members can monitor this stuff regularly and get a sense of how the marketplace is reacting to the prospects associated with inflation.

Going back to your previously comment on asset allocation as well as diversification, what does this mean in terms of of what stocks and sectors you’ll be looking at?

The primary aim of the newsletter is to go beyond the obvious ‘dividend payers’ like the banks or Telstra. There are hundreds of results payers in the market and my work is to uncover the quality companies that can sustain a dividend through the economic cycle. So I’lmost all be focussing on an ‘overlooked’ area of the market for sustainable dividend payers, if you want to put it that way.

The other aspect to keep in mind is that the dividend payers I’lmost all be recommending are long-term holdings. I recognise people need earnings from stocks for the long term and are less concerned about short term marketplace fluctuations. So I’m not going to try and time entry into and out of stocks. When the fundamentals are strong and also the divvy is sustainable, I’m happy to buy and hold.

What does that mean for mining stocks as income payers? Will they feature in Total Income at all?

Yes and no. A lot of the miners don’capital t pay a dividend anyhow. And some only do from cycle highs, which doesn’capital t satisfy my demand for sustainable dividends through the cycle.

One thing I will look at is a ‘special situation’ pick where I might look at a BHP, RIO…or a Woodside or Santos. It might be where it’s close to a cycle base for their particular or dominant commodity and they are paying out a sustainable dividend that should increase as commodity prices recover. It will be on the case by case basis, but these people won’t feature heavily.

Thanks Shiny and best of luck with Total Income!

To learn more about Matt’s methods for income trading and the initial recommendations that Total Income released with on Saturday, click here.

Regards,

Greg Canavan,

Editor, Sound Money. Sound Opportunities.

From the Port Phillip Publishing Library

Special Report: You’lso are about to discover a radically different way to build wealth. It’s the same alter market veteran Matt Hibbard created after 30 years battling away in the financial markets. These days he or she lives a relaxed, comfy life on Victoria’s Bellarine Peninsula…happier and more financially secure than he ever was prior to. And when you finish watching his brand new video, you’ll be with that road too.