Understanding the Death of the US Dollar

In spite of our dismal expense landscape, financial cheerleaders still influx their pom-poms and urge you to buy stocks and bonds ‘for the long run’. You only need to look at bond marketplaces to see what I mean.

Short term Treasuries possess almost no yield. Long-term Treasuries offer 2% if the investor is prepared to wager on no inflation for 10 years.

High-yield corporate debt is loaded with credit risk at this stage from the cycle. The defaults are likely to pile up as we enter a worldwide growth recession in early 2016.

Yet you’re urged to blindly enter this market. Based on assurances that all is well and the next Two decades will echo the past Two decades.

Meanwhile, the financial foundation constructed on the dollar is rotting away.

The historical precedent for the slow loss of reserve currency status is the strange case associated with sterling. The story begins with a geopolitical event far removed from the keeping track of rooms of London — the assassination of Archduke Franz Ferdinand, heir to the throne of the AustroHungarian Empire, by a Serbian terrorist in Sarajevo upon 28 June 1914.

When the First World War started on 28 July, 30 days after the assassination of the Archduke, all of the major belligerents immediately suspended the conversion of their currencies into gold except the UK. The conventional view was that nations needed to hoard gold as well as print money to pay for the war, which is why they suspended convertibility.

The UK took a different strategy. By maintaining the link to precious metal, London maintained its credit rating. This enabled the UK to borrow to pay for the war. It had been John Maynard Keynes who convinced the united kingdom to remain on the gold standard. It was Jack Morgan, son of JP Morgan, who organised massive loans in New York to support the British war effort.

Initially there were large outflows of gold from the US to the UK. Even though the United kingdom remained on the gold standard, investors sold stocks, bonds as well as land in the US, converted the proceeds into gold, after which shipped the gold towards the Bank of England.

In The fall of 1914, the flow of precious metal suddenly reversed. The Uk needed US exports of meals, wool, cotton, oil, as well as weapons. All of this had to be paid for either in gold or lbs sterling that could be converted into gold. The gold that had flowed eastern from New York to Birmingham now began to flow western from London to New York.

From November 1914 until the end of the war in November 1918, there were huge gold inflows to the Federal Reserve Bank of New York and its private member banks. It was at this time that the dollar emerged as a brand new global reserve currency in order to challenge the supremacy of sterling.

The process of the dollar replacing sterling began in November 1914, but there wasn’t any immediate or sudden fall of sterling. Throughout the 1920s, the actual dollar and sterling competed side-by-side for that role of leading reserve currency. Scholar Barry Eichengreen offers documented how the dollar as well as sterling took turns in the leading role with the lead transferring back-and-forth several times.

But by 1931, the race was becoming one-sided. The buck was starting to pull away. Winston Churchill experienced blundered by pegging sterling to gold at an unrealistic rate in 1925. The actual super strong sterling that resulted decimated UK trade, and set the UK in a depression 3 years before the rest of the world. UK trade deficits caused Commonwealth trading partners such as Australia and Canada to get stuck with huge unwanted reserves in sterling.

The increase of the dollar, and the constant decline of sterling continued through the 1930s until the start of the Second World War in 1939. At that point, the UK hanging the convertibility of sterling into gold. The international monetary system broke down for the second time in 25 years. Normal trade, currency exchange, and gold convertibility remained suspended until the international monetary system could be reformed.

This reform happened at the Bretton Woods international monetary conference held in New Hampshire in July 1944. That conference marked the final ascendency of the dollar because the leading global reserve currency.

From 1944 to 1971, major currencies, including sterling, were pegged to the dollar. The dollar was pegged to gold at US$35.00 per ounce. Bretton Forest was the definitive finish to the role of sterling as the leading reserve currency. The conference enshrined the dollar in the leading reserve currency part — a position it has held since.

The point of this history is to show that the replacement of sterling by the dollar as the leading book currency was not an event, it had been a process. The process played out more than 30 years, from 1914 to 1944. It involved a seesaw dynamic by which sterling would try to reclaim the crown only to lose it again.

With hindsight it is possible to see that the actual turning point took place in November 1914 when gold outflows from the All of us reversed and became inflows. Those inflows ongoing until 1950 despite two globe wars, and the Great Depressive disorders.

Yet, no one saw the fall at the time.

From the Bank of England’s perspective, November 1914 may have seen gold outflows, but no one believed the entire process of decline was inevitable or even irreversible. The belief in London was that Britain would earn the war, maintain the kingdom, and preserve sterling’s position because the most valued currency on the planet.

Britain did win the war, but the cost was too great. They lost the actual empire and sterling lost its role as the leading reserve currency. The issue for traders today is whether the US buck already had its November 1914 moment.

Is it possible that the collapse of the US dollar as the leading reserve currency has already begun? The answer is ‘yes’.

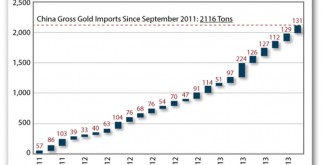

Looking at the huge flows of gold in order to China, the rise of a buck competitor in the form of the SDR, and the coming inclusion of the Chinese yuan in the SDR basket, it is difficult to not conclude that the dollar fall has already begun.

Yet, like the collapse of sterling a century ago, the decline of the dollar won’t necessarily happen overnight.

It is a slow, steady process.

Jim Rickards,

Strategist, Strategic Intelligence

From the Port Phillip Publishing Library

Special Report: If you want to get ahead in this world, it pays to have effective friends in high locations. With this new advisory, you’ll make one. A portfolio manager at the West Shore Group, and adviser on international economics and financial threats towards the US Department of Defense. Jim Rickards isn’t any ordinary financial newsletter author.?And Strategic Intelligence is no ordinary e-newsletter… (more)