Thirteen Drivers of Silver in Today’s Financial World

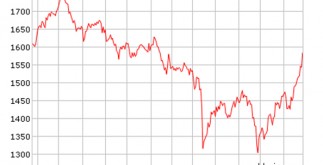

Silver has been in a bear marketplace for some time now, being down an in-depth 27% this year and a whopping 55% from the maximum it reached in 2011.

Needless to say, this has been uncomfortable to the growing number of silver investors in the Western world. (To satisfy booming demand, silver gold coin production has surged at the world’s mints and global holdings in exchange-traded products stay near a record high exceeding 600 million ounces.)

With the [US] dollar recovering strength this year and an improving [US] stock market, you may ask ‘Should I continue to hold an investment in silver?’

Obviously, each person needs to make his or her own financial choices. In my view, the answer remains indeed and below I list the 13 main motorists I believe will drive the silver price greater in the years ahead.

1. Gold, a hybrid precious/industrial metal, is really a commodity play on global technical advancement. Silver was once extremely dependent on the film digital photography industry, which collapsed in to insignificance with the rise of the digital camera, a major reason for the metal’s weak price in the 1990s.

Today silver’s industrial demand is driven by brazing alloys and solders, growing electronic demand (smartphones, tablets, plasma panels as well as increasingly by new programs like silk-screened circuit paths and radio frequency ID tags) photovoltaics (solar panels) as well as new medical applications: silver is both biocidal and extremely conductive.

2. Silver moves with gold. Though the metal exhibits more price volatility than gold being an investment asset, silver offers been correlated more closely with gold than with anything else for 2 generations. Despite sometimes violent market swings, silver has kept pace with gold and has even outperformed it over a lot of the past decade. This is a return in order to normality, in my opinion, as the sister alloys moved in tandem for thousands associated with years, notwithstanding the historic interruption between the 1870s and the Nineteen thirties, caused by adoptions of the Gold Standard.

3. Being an investment metal, silver is much more precious, less industrial. Gold is significantly more correlated along with gold than with industrial metals, like copper, which means that the market regards it as more of a safe-haven rare metal than an economically sensitive commercial one. This was seen throughout the 2008 crisis: though gold declined, it outperformed collapsing stock markets and commodities by a wide margin. The exception was precious metal, which rose in that year.

4. Silver is rarer compared to gold in the investment globe today. Total aboveground silver of any type is worth approximately $800 billion, regarding one-tenth the value of the world’s precious metal.

Although there are 5 times more ounces associated with silver in the world, because gold is more than 50 times more expensive than its sister metal per ounce, the actual silver market is effectively smaller. Silver is becoming rarer every year due to annual unrecoverable loss of tons of silver in industrial actions. Throughout history, tens of billions of ounces of silver happen to be used up in industrial production. Compare this fact with gold, the vast majority of which remains around today.

5. Silver is a leading real asset for inflationary occasions. Sister metals gold and silver frequently outperform other real assets in times of significant monetary expansion (they each surged over 2,000 percent in the 1970s) because they have a relatively small fixed supply, are nonperishable, liquid (because investments), easily storable, and historically recognized as alternatives to government-issued cash.

Over the final decade, a time of dramatic monetary testing, silver has outperformed all actual assets (real estate, commodities – even gold) by a wide border, not to mention the stock and bond markets. It also surged during the inflationary 1960s and 1970s. However, all real assets (houses, commodities, precious metals) have investment trade-offs, and silver’s risks are essential to consider.

6. Government today is silver’s friend: Amidst global financial excess, unprecedented and extreme use of monetary tools is the only major policy our frontrunners have. To help the economy recover from the 2008 economic downturn, the worst since the Great Depression, global leaders assumed more debt than ever to boost the economy (with credit).

With bloated balance sheets, expansionary financial policy options at present are restricted and increased central financial institution money-printing, which is already being used all over the world as a major policy device, will be vital when the next recession arrives.

7. Large investment fund ownership of silver is in its infancy. Even though the metal has been one of the successful investments of this new hundred years, pension funds, insurance companies, and other large institutions managing tens of trillions in assets have largely ignored silver as a viable investment. Gold very recently was reincorporated into the financial system as the viable, respected financial asset it once was. In the scramble for scarce global real assets, institutional traders are likely to begin considering the investment merits of silver, which is highly correlated with gold.

8. The actual gold-silver ratio, a 3,000-year-old exchange rate, is out of historical balance. While gold is 8 times scarcer than silver (when it comes to total ounces produced yearly), its price is more than Fifty times higher than silver’s. For 3,000 years in which the exchange rate could be observed, gold was 9 to 16 times more expensive, making today’s level historically extreme.

Now that lots of the factors distorting the ratio possess disappeared, it seems logical that the market exchange rate between the two should begin to approximate the difference in scarcity of each steel, which points to silver becoming significantly undervalued.

9. Like precious metal, silver is an ‘anti-bond’ and ‘non-stock’ – meaning it’s one of the few investment automobiles allowing a person to completely eliminate wealth from the financial system. Traditional financial assets represent claims on other entities.

To preserve their own value, bonds require that a government or company make interest and principal repayments; stocks require dividend payments and/or which management deliver on revenue expectations; derivatives of many kinds can require financial belief at multiple levels; and ultimately, the financial system itself depends on trust that world economic leaders will keep markets functioning properly by meeting their ever-expanding financial commitments.

Gold as well as silver, inert metals recognized for thousands of years as stores of wealth in whose nature cannot be altered by individual error, have value away from financial system.

10. Growing global scarcity of safe assets that are not someone else’s liability. According to the Worldwide Monetary Fund, of the world’utes potentially safe investment assets, 89 percent are bonds associated with some kind – that is to say, someone else’s debt. For those believing that greatest financial safety should not involve lending money to a company or government (buying a bond), there’s only gold, the other Eleven percent. But given the scarcity of gold and other real assets that are not economically sensitive (just as real estate and major commodities are), silver is increasingly being regarded as a viable alternative to precious metal, which it was for most of human civilization.

11. Anyone anyplace can buy silver. Silver is an investment that can be made in any country by virtually any person – even just in countries where there is no stock exchange, where even apple, the fruit, is hard to find. An ounce of gold, presently worth in excess of $1,350, is an investment inaccessible to most people in the world, and represents a difficult financial decision for middle class families in the United States.

A $20 silver coin is one thing that can be bought by a large number of people almost on a whim, a small investment decision that chips aside at globally scarce supply. If expectations for long term inflation begin to rise – a concept that virtually any working adult understands – silver’s well-known positive sensitivity to raised prices in the economy and its very accessibility could make it an essential asset for many.

12. The Eighties and 1990s bear market for precious metals had powerful drivers that no longer exist. In the 80’s the world’s two richest families conspired to manipulate gold and inadvertently caused a crash – together with plenty of metal-fearing fallout. This was surely a singular moment in history.

Also contributing to an overall headwind for the metals, main banks dumped an average 10 million ounces of gold for each of 20 years ending in 2008. This likely-unrepeatable event pushed gold through being close to 50 percent of worldwide central bank reserves within 1980 to an all-time low of 14 percent in 2012.

Heavily weighted in dollar, euro, and yen reserves and fixed income securities, a number of central banks are diversifying back into gold. The 1990’s saw increased pressure on silver prices due to the collapse of film photography, the largest source of demand for the actual metal. But film photography is in silver’s past, a very small part of demand these days, and investment demand has become the key driver.

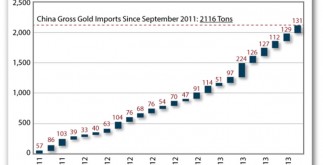

13. Silver is an important investment asset in Asia, where demand has remained strong more than thousands of years. Throughout Asia, however mostly in populous India and China silver, such as gold, is a key investment asset worn and stored as a wealth instrument by a great many people.

Every year, generally past due in the summer and into the drop, the silver and gold markets are deeply influenced by a major financial event–the Indian wedding period, which draws a substantial portion of the world’utes precious metals as part of an enduring millennial custom.

Silver’s Bottom in View?

In spite of present market conditions, this list helps us focus on the important drivers of silver for the years ahead that distinguish the metal from other investment choices.

Silver has the highest price sensitivity to inflation of any commodity or sector in the stock marketplace, by far – and it most certainly outperforms ties when the price level is rising in the economy.

If you believe – as I do – that the world’s monetary authorities will never allow deflation to take hold and that the odds of rising cost of living climbing to some degree in the years ahead are significant, it makes sense to possess some silver to diversify neglect the portfolio. (The right percentage to carry is something you should carefully consider with an investment advisor.)

Timing any investment properly is always a challenge, but silver’s price has fallen by half in the last two years and is beginning to show tentative signs of bottoming. Probably the worst has passed for silver.

Shayne McGuire

Contributing Writer, Money Morning