The COMEX Gold Shortage

‘Remember, remember the fifth of The fall of.’

Earlier this week, November Fifth, was Guy Fawkes Day in England, which commemorates when Guy Fawkes (who else?) tried to inflate Parliament in 1605. More on that in a moment, because right now that’utes the least of our worries!

Today we have larger fish to fry….

There’utes a stunning development in the world of precious metal buying and selling. In fact, there’s a huge gold shortage across conventional markets. This shortage may be a precursor for a cost melt-up. Let’s look at some charts.

Click to enlarge

What’s going on? What do these graphs mean?

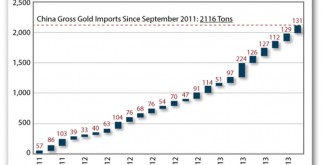

Above you’ll see ten years’ worth of visual data concerning gold trades on COMEX, which is a good exchange that offers warehouse services for clients who trade metals. That is, COMEX stores precious metal at designated sites, on behalf of its clients. When you read about ‘gold trading’, this is the gold that will get traded.

Let’s back up for a moment. COMEX holds metal on deposit to settle futures contracts, in order to back-up buy/sell deals and to secure exchanges between parties. On occasion, gold gets withdrawn from COMEX warehouses. (Too many occasions in current months, as we’ll observe below.)

As part of its ‘exchange’ service, COMEX problems daily reports that detail its stock of gold, silver, copper, platinum, palladium and more. That is, COMEX states exactly how much metal is stored in its industrial environments ., and how much metal is available for trades.

In general, the idea behind daily COMEX reports is perfect for traders to know how much metal is there to support futures agreements. The data also give understanding of what large gold (along with other metal) owners are doing in terms of trades and settlements, also as how much metal has been drawn out for delivery. So far, so good.

Take a look at the top chart where it shows the price of gold (in yellow) and also the ‘open interest’ in gold agreements (in dark blue) through 2003 to the present. This reflects more and more players getting into gold commodity during a decade-long price rise.

The open interest designation reflects the number of choice and/or future contracts that are not closed out – thus leftover ‘open’. Note a general rise in open interest between 2003 and Next year, and the decline over the past 12 months. Makes sense, right?

Now take a look at the second graph. It shows how much gold is represented by the open interest. That is, how much precious metal it would take to satisfy all the contracts out there, if people really demanded delivery.

Back in 2011, the number was north of 60 million ounces, or about 1,700 tonnes (metric tons). Today, it’s just less than 39 zillion ounces, or about 1,100 tonnes. One way or another, it’s a lot of gold, to be certain.

Then again, most traders just offer ‘paper gold’ and not the real thing. Many people trade gold for the dollar-side of the deal, not because they want to take delivery and hoard gold in their vaults, let alone bury it in a treasure chest in the back yard. Still, the graph shows how much gold is in play just via COMEX.

Big Physical Gold Shortage Developing

Now look at the bottom two graphs. Note the second in order to last graph. It displays an abrupt drop in ‘registered’ gold stocks over the past six months. That’s gold eligible for COMEX delivery. The graph distinctly shows quantities shrinking fast, to about 660,Thousand ounces – which is the point of drying up, certainly as compared with average levels over the past ten years approximately.

Finally, take a look at that bottom graph. It reflects the number of ‘precious metal contract’ investors with a claim on each potential COMEX ounce. Looking back in order to 2003, COMEX data reflect between 10 and 20 possible ‘owners’ for each ounce, with an excursion as much as the 30-range in 2011.

But look what occurred in the past few months. The number of ‘proprietors per ounce’ has spiked up to an unprecedented 55! In other words, in the event that fewer than 2% of COMEX gold agreement owners hold their jobs to expiration, and then ask for delivery, COMEX warehouses would be cleaned out. The other 98% of gold contract players would be left holding a clear bag.

What does this mean? COMEX numbers clearly show a severe squeeze on physical gold. The gold that backs ‘trades’ is at an all-time low! The registered gold inventory is at crucial shortage, unprecedented since the times of $300 gold back in the early 2000s.

Where’s the Gold?

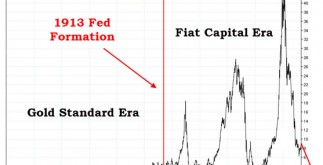

Meanwhile, the well-publicized, ongoing disgorgement through ETF plays, such as SPDR Precious metal Shares (GLD) is NOT going into stockroom inventories, certainly not at COMEX. Actually, the evidence is that this gold will refiners in Europe, and thence to China and other gold-buying locales. The actual GLD outflow is no longer available to Traditional western investors – not at current costs.

Here’s a trend that is NOT your own friend.

The gold is disappearing, and I strongly suspect that it won’t come back in our lifetimes. National wealth – in the form of gold – that required generations to accumulate is leaving our economy. It’s migrating east.

Should we be worried? Well…it will only take a small change in ‘gold psychology’ for more and more Traditional western investors to figure out what’s happening. The smart ones will demand delivery of physical metal, and the sooner the better. Only then do we could see a price melt-up for gold unlike anything in modern history.

What should you do? Should you own physical gold, smile and hang on. If you don’t own physical gold – or silver, platinum or palladium – acquire some.

If you own mining shares, hang on too. We’re in a bottom stage of the past year’s share price melt-down. Long term, valuations will rise.

Don’capital t Be Misled by the Laying Liars of the ‘News’

Meanwhile, watch the news. You’ll observe and hear ‘big names’ in politics, economics, monetary policy, the actual mainstream media and big banks continue to bad-mouth gold. At root, they lie! They are lying liars! Oh, they lie such as dirty rugs! These lying honchos tend to be desperate not to let the news of a physical gold shortage become too well-known. They cannot afford – in almost any sense of the word – for large amounts of investors to understand how poor things are with gold inventories.

This physical COMEX gold shortage could quickly change into a widespread run on precious metal. When more and more people figure out how risky is the situation with physical gold, the metal markets can come afire like Yellowstone Park, burning to the ground back in 1988.

Back to Man Fawkes

One last point, concerning the Fifth of November. Guy Fawkes had been one of the central players in the Uk ‘Gunpowder Plot’ of 1605. Fawkes was an British Catholic who joined a plot in order to assassinate King James I (of Bible-fame), and then restore a Catholic monarch to the Uk throne.

Fawkes and his co-conspirators placed barrels of gunpowder beneath the House of Lords, intending to take out much of the British management in an explosion. However, someone tipped-off the king’s inner circle, and government bodies searched Westminster Palace during the early hours of Nov. 5, 1605.

The constables discovered Fawkes guarding explosives. Fawkes was arrested, questioned and tortured until he broke as well as spilled the beans about his plot. Fawkes was sentenced to be hung, dragged behind the horse and cut into four pieces on Jan. 31, 1606 – speedy justice, back then – however jumped from the gallows rather than give their English captors the pleasure of torturing him to death.

Today the actual name of Fawkes is synonymous with the actual Gunpowder Plot. In Britain, they commemorate Guy Fawkes Day by burning the man’s image in effigy as well as setting off spectacular fireworks.

But when COMEX gold runs out, we’lmost all have bigger things to be worried about than plotters wanting to blow up the homes of Parliament. Beware, beware…

That’s just about all for now. Thanks for reading.

Byron King

Contributing Editor, Money Morning