Supportive Fundamentals Exist While Dollar Technicals Stretch

The underlying driver of the forex market is the divergence between the US and the other high-income countries. This was underscored previously couple of weeks. Between the BOJ and the national pension fund, monetary stimulus and capital outflows are set to accelerate from the world’s third biggest economy.

The ECB underscored its commitment to broaden its balance sheet and looks for other measures to apply as the risks align towards the downside. The signal ongoing to come from key Fed officials is that barring a significant downside surprise, the Fed will initiate a walking cycle next year.

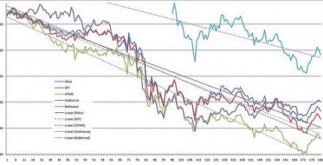

The dollar’s technical condition, however, is stretched. Emotion is extremely one sided. Virtually everyone is bullish the dollar and bearish the euro and yen. The dollar’s inability to industry higher, despite the constructive work report before the weekend appears to reflect the reluctance of recent dollar longs to come in without a pullback. The dollar might indeed drift a bit reduce at the start of next week, in a mostly corrective/consolidative fashion.

Euro: Initial resistance is pegged near $1.2470. Above there, the $1.2500-30 area is seen a far more solid cap. Given the confidence level of many participants, this triggers a short squeeze a move above $1.2600 is needed now. The economic calendar warns of a slow start to the new week. The next major downside objective, ahead of the psychologically important $1.20 degree is the potential trend line connecting the 2010 low (~$1.1880) and also the 2012 low (~$1.2040) comes in close to $1.22.

Yen: Since the BOJ/GPIF surprised the market on October 31, the actual yen has more than 5%. Like the euro, the technical indicators are warning of an over-extended market. However, downticks continue to brief as well as shallow. Initial support is likely near JPY114. Chart-based resistance occurs in front of JPY116 and then JPY117.60.

Sterling: Brand new lows since September The year 2013 came before the US jobs data, near $1.5790. Although it managed to recover, it stalled within the lower end of the previous day’s range. Initial resistance is seen near $1.5880 and then $1.5920. On the drawback, the next objective is near $1.5725, which represents the 61.8% retracement from the rally off the July 2013 low near $1.4815.

Canadian dollar: Strong employment data helped the Canadian dollar recover in to the weekend. However, the US dollar pullback to CAD1.1330 fulfilled the minimal retracement objective off the October Twenty nine low near CAD1.1120. A further drive could see the greenback test CAD1.1275-95. The CAD1.15 level neared, while offering the immediate psychological resistance, when it passes; the next main target is near CAD1.1725.

Australian dollar: The Australian dollar staged an impressive recovery before the weekend break after making new four-year lows that matched the 50% retracement from the gains recorded off the 08 low near $0.6000. The actual RSI and MACD trended higher in Oct. There has been no validation of the pullback in prices in early The fall of. There is near-term scope for the Aussie to test the $0.8660-80 area, which may also offer a new selling chance.

Mexican peso: After retreating at the start of the week, the actual peso traded sideways through the remainder of the week. Technically, the buck looks poised to slip back again toward the October Thirty-one low of MXN13.40. Area of the difficulty in selling dollars for pesos is that it is not obvious when to place a stop. Having said that, on a relative basis, from the euro, for example, or pound, the peso can outperform.

S&G 500: The US employment information led to new record highs. Of the mid-October lows, it has rallied nearly 12% and only once has seen 2 consecutive losing sessions. The larger October 31 opening created a small gap (1990.40-2001.Twenty). The gap, pierced on November 4, did not close. This should provide support though initially we suspect support around the 2015 region.

US 10-year Treasuries: The yield peaked simply shy of the 2.40% degree after the US jobs information and dropped nearly 10 bp. The futures market reflected this, with an outdoors up day for the US 10-year note futures. The lack of key data in the early part of the new week could see yields drip a bit lower. The 2.27% region is interesting and then 2.20%.

Light Sweet Crude Oil: The Dec futures contract recorded greater lows in the second half of last week, but was still not able to resurface above the $80 level. The RSI and MACDs did not validate the actual November 4 low near $77.25. Above $80, the next target is $82.

Observations from the speculative positioning in the futures market:

1. There have been three significant (more than 10,000 contract) adjustments in gross positions. The gross lengthy euro position was cut by a little more than 5% or Thirteen.8k contracts to 238.6k. The yucky long yen position flower more than 50% or 14k contracts to 37.9k. The gross brief yen position rose 20% or even 18.3k contracts to 109.3k. This report covered the two days before the BOJ/GPIF announcement (Oct 31) and two days after.

2. The general pattern among the currency futures in the latest CFTC reporting period ending November 4 was for both trend follower and bottom pickers to get more involved. The growth of both gross wishes and shorts reflected this. Of the seven currencies we track, two were exclusion. The euro, which saw a cut in gross pants, and the Australian dollar, which saw gross longs, trimmed.

3. Activity was concentrated within the euro and yen. No other gross currency positions changed by more than 4k agreements.

4. The net short 10-year US Treasury note futures position increased in order to 47.3k contracts from Thirty-five.8k. This was a function of wishes cutting (almost 17k contracts to 414.4k) and a small covering associated with shorts (nearly 5.4k contracts covered to leave 461.7k contracts).

Dollar Technicals Extended, but Fundamentals Remain Encouraging is republished with permission through Marc to Market