QE, QE and more QE (Let’s Talk Gold…)

Today we’ll discuss the prospects with regard to gold and silver.

But first, let’s talk about Richard Nixon.

That is, after he lost the election for governor of California in 1962, he remarked to the assembled information reporters, ‘You won’t have Nixon to stop around anymore.‘ Of course, everyone knows what happened with Mr. Nixon in later years.

(Heck, speaking of gold, Nixon took the US from the gold standard in 1971. And it was on Nixon’s view that oil prices quadrupled within 1973. But I digress….)

Nixon’s so-called ‘final press conference’ came to mind when i saw news that former Treasury secretary and presidential economic adviser Larry Summers…umm…’withdrew’ his name from consideration to be the next chairman of the Federal Reserve.

He won’t succeed the current Fed ramrod, Ben Shalom Bernanke. Yes, indeed. Larry Summers withdrew his name. I just read it on the internet, so it should be true.

Did Summers walk? Or was he ‘helped’ in making their decision? Or just plain pressed? Whatever happened, I’ll wager Summers thought long and hard about whether or not to plunge into that Given briar patch with his monetary bud whacker. His designated role would have been that of the central financial institution ‘fall guy’.

That is, the duty Summer season won’t seek is similar to the mission of Paul Volcker during the late 1970s and early 1980s. Volcker was the Fed head in an era of flaming inflation and economic stagnation. Volcker gritted his teeth and raised interest rates to nosebleed levels, which smashed inflation down – and tore the guts from an already weak economy.

In an alternative universe, today Summers would have had the uncomfortable duty of scaling back on Bernanke’s still-raging $85 billion per month plan of quantitative easing (QE). Hey, somebody needs to fall on that monetary hand grenade sooner or later. But I guess it’ll be later. And the perp won’t be Larry Summers.

Keep the QE Flowing

Evidently, big shots inside the Obama administration and the Senate noticed that our grand US economy is less robust than they would like. Plus, we have looming budget battles and political dogfights over taxes and spending.

Add in the approaching surprise of Obamacare – a job-killing, economy-wrecking tsunami already flooding over the land, from what I can see (long story). So the issue for the Federal Reserve becomes whether to accelerator QE just now or let the Fed’s money spigot run.

Politically, it’s dangerous to scale back on QE. Or to paraphrase that old line about cancer, there are more people living off it than dying from it.

So evidently, policy honchos within the Obama administration told Bernanke to help keep the Fed’s signature easy-money programs in position for a while longer. How much longer? Well… through this fall, at least. Then we move into 2014, when the All of us will hold elections for the entire House as well as one-third of the Senate. So politically, this can be a no-brainer, and QE should last a while longer.

Volcker’s Ghost

Getting back to Ray Summers, I suspect he knows what happened to Paul Volcker back in the 1980s, once the guy battled America’s inflation problem in a post-Vietnam, oil-shocked economy.

In terms of monetary policy, Volcker did what he or she needed to do. Volcker raised curiosity rates. He raised them high!

I lived through this. It was good to be a saving idea or lender, but I additionally recall that Volcker’s high interest rates sure stung if you were the customer. Ugh. I once signed up for any 16% rate on a used car mortgage – a beat-up Dodge Omni, no less! I still cringe at the thought.

In the larger picture, Volcker was much hated in many quarters. In the Area at the time, the steel and auto industries had been contracting due to rising global competition. (It’s where the term ‘Rust Belt’ originated.)

Volcker’s high interest rates made things worse, leading to more plant and generator closings and attendant layoffs. People rioted in the streets against Volcker and burnt him in effigy. As things unfolded, Volcker required personal protection due to death risks.

I’ll add this for viewpoint, though. Back then, the world was in the depths of the Cold War. The West faced a very real as well as dangerous nuclear threat from the former Soviet Union, which set the overall political tone. Absent that, I doubt that either President Jimmy Carter or even President Ronald Reagan would have gutted it out with Volcker’s high interest rates, even to halt rising cost of living and save the dollar.

In other words, no matter how bad issues were with Volcker’s high interest rates, the politicians could rationalise it all as well as think it was better than losing out in the Cold War to the evil commies, if not getting nuked. Nowadays, we lack that comforting selection of alternatives.

Thus, Larry Summers ought to inhale sighs of relief at missing out on receiving rivers of unadulterated hate from entire populations over the now wired-in world, which lacks the previous military motivations of the Chilly War era. Really, today those flash mobs of ‘Take up This or That’ can monitor you down in a heartbeat.

So Summers will avoid the fate of personal vilification and destruction that’s or else primed and aimed at whoever takes the dirty job associated with draining a trillion dollars per year of fake Fed liquidity out of the global economy.

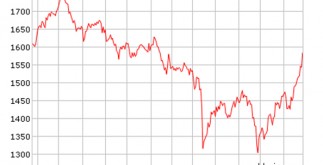

Indeed, global marketplaces were setting up to sell away at merely the hint associated with Summers at the helm of the Great Ship Fed. And then? Forget about Summers. Bernanke announced more QE. And the markets firmed up – as did gold prices.

Also, as per the coming in contact with custom of Kabuki theater that’s modern Washington, DC, President Obama graciously accepted the Summers drawback. Heck, Mr. President actually offered kind words for Mr. Summers’ many years of national service. Right now we can only wonder about what might have been with Summers running the actual Fed. What might he have accomplished? Scaling back QE? We’lmost all never know.

Recalling the Happy Golden Bygone Days

Then again… let’s not overly romanticise Ray Summers. It’s not as in the event that he’s a ‘doomed son of heroes’ out of the tale associated with Ossian, riding toward the steel.

When I think of Larry Summers, I look back to his tenure as president of Harvard, where he left a mixed legacy. For example, he initiated a long-overdue attack on grade inflation – sort of a ‘QE of grades’, if you will. Bravo!

Summers additionally encouraged several academically challenged Harvard faculty members to seek other possibilities. I won’t mention names, but the matter is not precisely a state secret. Again, bravissimo to Summers!

But then Summers oversaw the loss of $2 billion of Harvard endowment funds due to bad interest rate swaps, a subject on which he’s said to be an expert – or at least the neatest guy in the room.

On that last matter, consider that Harvard’s undergraduate tuition is about $50,000 per year, per student. Therefore Summers losing $2 billion is the same as burning a year’s originate from 40,000 students.

But there are only about 6,000 undergraduate students on campus in almost any given year. Thus, one could say that Summers broke Harvard’s enrolment bank – zeroed the account – for almost seven entire years of procedures. Ouch.

Of course, Harvard continues to perform, as one might expect of an enduring institution that dates back in order to 1636. And the US will likely endure as well – QE or no – considering the resilient national history since 1776.

No matter who runs the Given, though – and it won’t be Larry Summers – I think we’lso are in for a rough ride for a while. At least for now, we won’t possess Summers to kick around.

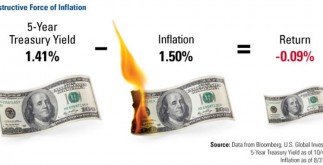

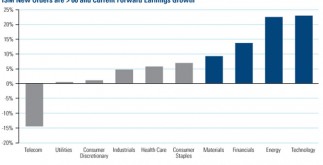

What’s the takeaway right here? QE, QE and more QE. The Fed is actually propping up Wall Street, to speak, while the ‘real’ economy languishes. It’utes investable for stock pickers. And buy physical gold. Buy physical silver. Hold oil. The buck will live through another duration of troubles. That’s where this really is heading.

That’s all for now. Thanks for reading.

Byron King

Contributing Editor, Money Early morning

Ed Note: Larry Summers Won’capital t Burn in Effigy originally made an appearance in The Daily Reckoning USA