Investing Amidst the Gold Market Ruins

‘Never laugh at live dragons,’ wrote J. R. R. Tolkien in his classic book The Hobbit, published in 1937.

Tolkien was on to something, I believe. His words come to mind since i keep seeing more and more information about China – the national indication of which is the dragon – and its many citizens buying more and more gold. It’s fair to say that China and also the Chinese hoard yellow metal.

Not sometime ago, for example, I saw video of Chinese rioting over access to the gold-selling mall in Shanghai. Evidently, some Chinese are desperate to convert their currency into gold. It’s a gold-lust much like that of Tolkien’s gold-loving dragon named Smaug:

‘There he lay, a vast red-golden dragon, fast asleep…about him on all sides stretching away across the unseen floors, lay countless piles associated with precious things, gold wrought and unwrought, gems and jewels, as well as silver red-stained in the ruddy light… [The] hobbit could see his underparts and his long pale belly crusted along with gems and fragments associated with gold from his lengthy lying on his costly bed.‘

If you’re looking for gold, We don’t recommend walking into the lair of the fire-breathing dragon. But I’m okay with accumulating gold and gold shares by way of less dangerous means, and today I’ll explain my logic.

In fact, despite a generally ‘down’ market for gold this year, I’ve got my eyes on cheap miners. Some of these shares are going to be a great buy from current, beaten-down gold prices. And looking ahead – within the long-term – what if gold prices increase?

Considering an economy marked by low interest rates and all types of bizarre government policies, long-term gold fundamentals are still holding true.

What about Those Chinese?

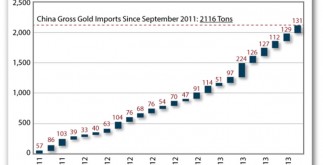

First, let’s visit again Chinese gold-buying. It’s just amazing. The Chinese government and people are buying gold by the tonne (metric lot). See the nearby chart associated with Chinese gold imports from Hong Kong, showing strong, steady accumulation over the past two years.

Click to enlarge

In particular numbers, since September 2011, China has imported 2,116 tonnes of gold. That is, in just over two years, China offers imported almost the equivalent of the entire gold reserves of France (2,435 tonnes) or Italy (2,451 tonnes).

According to the World Precious metal Council, about one-third of China’s gold imports are due to individual Chinese purchasers who want to own ‘personal’ gold, as bullion and/or jewellery. That is, the buyers are people who don’t want to tie up their wealth within the Chinese yuan – the national currency. There’s also a modest amount of brought in gold going for industrial use in electronics and such.

Much of the rest of the precious metal going to China – well over half – is, apparently, destined for the Chinese central bank. This gold is supposed to back up government monetary coverage.

Like Smaug the dragon, the Chinese perform what they do. Or look at it one other way. Here in the West, monetary players and many mainstream media commentators heap disdain upon gold. The conventional wisdom is to sell precious metal.

We see that conventional wisdom reflected when minimal gold prices fall and large gold holders like SPDR Precious metal Shares (GLD) liquidate holdings. Obviously, for every seller, there’s a purchaser, and right now, on net balance, the Chinese are buying every oz sold, and then a few.

It’s not far-fetched to believe that despite the harsh words of Western ‘experts’ against gold, the People’utes Bank of China (PBOC) is actually making good on it’s quietly stated long-term goal of developing a gold-backed national currency.

Meanwhile, China is actually making trade deals with a web host of nations in which individuals nations trade with China using their own national currencies and also the Chinese renminbi (the currency used in international trade). This cuts the united states dollar out of the cycle.

There are deep issues to ponder here. Why are Chinese people as well as their government so eager to purchase and import gold? What will they know? Why does the Chinese government make so many bilateral trade deals? Why don’t the Chinese desire to use the dollar? What’s the strategy at work?

Really, don’t the Chinese know that yellow metal is just a so-called ‘barbarous relic’ within the eyes of many Western economists as well as political gurus? Are the Chinese trying to take the world back again to the days of Middle Planet and hobbits?

What Do the Gold Cost Charts Tell Us?

Let’s follow the facts and look at gold price charts. As you can see in the chart beneath, the price of gold declined this year, after a long run-up over the past decade:

Click to enlarge

See the close-up chart below, associated with gold prices this year, showing the actual 2013 decline in more detail. It’utes a steady price deterioration, although perhaps we’re near the end of this downturn. Could precious metal prices fall further? I hope not really, but never say never.

In the past year, the price decline for gold has dragged down share prices across the gold-mining field too. Here’s a 10-year chart for the Market Vectors Gold Miners ETF (GDX: NYSE). For the sake associated with comparison, I’ve thrown in the Market Vectors Gold ETF (GLD: NYSE) as well.

Click to enlarge

So here’s what we should know. China is posting large amounts of gold. Western holders are selling gold, as evidenced by the GLD decline and outflow. And gold miners are harming, as we see from GDX.

In short, The year 2013 has been a strange year for gold. China lit the physical gold market on fire along with overall purchases and imports. But you’d never know this from gold’s price, which has fallen more than 20%.

Investing Amongst the Golden Ruins

After all of this, what do we really know? In the Western world, big holders are selling gold – GLD and so on. In the East, multitudes associated with Chinese are buying. What should you do?

On the one hand, be careful plunging into a turbulent gold and mining share marketplace. Gold is not the latest trading fad, to be sure. Gold does not have that sexy allure of the latest high-tech vaporware or the aluminized hand-held device that’ll be obsolete in eight months.

On the other hand, if you foresee rising gold prices over the long term in an era of volcanic federal government spending, there’s nothing wrong with buying into the best of the best exploration plays while they’re beaten down.

Remember, the Chinese are hoarding precious metal. Demand in the Middle Kingdom offers far surpassed gold mine production in the rest of the world. The only way for the global gold market to meet Chinese language demand is to sell stockpiles – the GLD stashes of the world.

Sooner or later, the steering wheel will turn for precious metal. And when that happens, the markets will encounter a provide deficit unlike anything we’ve seen. When that deficit strikes, we should see gold prices increase upward. When that time arrives, it’ll be good to hold your favorite mining plays – they’re certainly inexpensive right now.

Until next time. Thanks for studying.

Byron King

Contributing Writer, Money Morning