How to Profit from the Currency Wars

On 14th January this year, one of the greatest ‘battles’ in the long running worldwide currency wars started.

It took most investors by surprise.

And for many investors, not only did it take them by surprise, but it wound up costing them millions, and in some cases, billions of dollars in losses.

That event, that major battle, was when the Swiss Nationwide Bank ended its peg towards the euro in January this season.

The Swiss had maintained a peg to the euro for three many years. Why would they do that? It had been all due to the European Main Bank’s (ECB) policy of devaluing the actual euro through money publishing.

The ECB wanted to devalue the euro in order to help boost exports. It’s the same reason why the US wanted to devalue the US dollar by printing more.

The trouble for Switzerland is that a devalued euro would mean an increase in value for the Switzerland franc. The Swiss feared that will result in a drop in exports and harm the Swiss economy.

So the actual SNB pegged the Swiss franc to the euro. It meant that as the ECB printed euros to devalue its currency, the SNB would need to actively sell Swiss francs within the foreign exchange market, to push down the value of the franc.

That too would involve printing money.

But all of a sudden, in January this year, the SNB gave up. The ECB announced it planned to open up a brand new money printing program, and the SNB realised it just couldn’t maintain pace.

So they decided to unpeg the Swiss franc from the euro. The impact on the currency markets was large. As Business Insider reported at the time:

‘Hedge account manager Marko Dimitrijevic is closing their largest hedge fund, Everest Capital’s Global Fund, having lost almost all its money after the Switzerland National Bank (SNB) scrapped its three-year-old cap on the Swiss franc against eh euro, Bloomberg news reported upon Saturday.

‘Citing a person familiar with the actual firm, Bloomberg said the fund had been betting that the Swiss franc would decline. The account had about $US830 million in asset at the end of 2014, according to a customer report cited by Bloomberg.‘

The chart below gives you a clue to when the SNB abandoned the peg. See if you can spot it…

Source: Bloomberg

The Swiss franc appreciated by 23% over the euro within 24 hours.

It was a stunning move. As the report above highlights, some funds lost a lot of money on it.

But, not everyone lost. There have been plenty of savvy investors and institutions that made a eliminating on the SNB move.

As Fortune noted simply two weeks later:

‘Banks are finding their own way around the Volcker Rule in some unexpected ways. JPMorgan’s recent windfall from the Swiss franc — and Citi’s loss — is actually testament to that fact.

‘Earlier this 30 days, traders at the nation’s biggest bank made $300 million in one day, following news the Swiss central bank was taking its cap off the franc. That caused the currency to soar, and JPMorgan traders took the move, actually, to the bank.‘

Why did the Swiss franc move this way? Because of the global currency wars.

Now, era of this extreme nature are abnormal. They don’t happen all the time. But other events, mostly of a smaller nature, perform happen…and they happen more frequently than you may think.

And not just in the currency markets either.

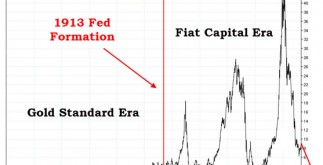

Look at the following chart. It’s of the gold price in US dollars.

From late December to mid-January, it moved nearly 11%.

Source: Bloomberg

Why did gold go ballistic like this? Because of the global currency wars.

Cop a look at another chart, this time of the Brazilian real. It moved 27.8% in just 8 weeks:

Source: Bloomberg

Why did this happen? Because of the global currency wars.

From 03 to April this year, Brazil’s IBovespa index gained 20.2%.

Source: Bloomberg

Why did it do this? Because of the global currency conflicts.

In 2013, Indonesia’s main stock catalog fell 23.6% in 3 months. Why? Because of the global forex wars.

Source: Bloomberg

Look at any of the charts I’ve shown you and you’ll see big price movements over relatively short periods of time. Many of these are a result of the global currency wars.

It’s these price movements, associated with the currency wars, that we’re targeting with a brand new trading advisor, Currency Wars Trader.

Just note one thing. Even if this service aims to help people profit from (or protect their own wealth from) the global currency wars, it doesn’t involve currency trading.

This new service aims to help investors and traders profit from the actual currency wars without really trading in currencies themselves.

It’s a unique trading service. It doesn’t involve technical analysis. And if a person so choose, it doesn’t need to involve leverage either (although if you want to sensibly employ influence, we’ll show you how).

And it’s not fundamental analysis in the conventional way either. Our strategist and analysts aren’t looking at company balance sheets and profit and loss statements as you’d expect.

This is what We call ‘macro-fundamental’ analysis. It’s exploring the big economic news and events, looking for hidden triggers within the market, using our strategist’s unique approach.

After the strategist offers identified these triggers as well as signals, it’s then up to the analysts to apply that to a specific investment idea.

That calls for buying or selling a particular type of investment that they believe is best placed to profit the most from an anticipated move.

It’s sure to be controversial. This is a strategy that until now has been unavailable to the ordinary investor. But now, as the global currency wars gain maintain, and have an ever greater influence on the markets, it’s only right that we make this strategy open to you now.

Cheers,

Kris