Gold Smugglers Aren’t Meeting The Demand…

So in the end the US government debt debate gets resolved for another few months. Except nothing has really been resolved, mostly just delayed. Place an entry in your calendar for the similar cycle to repeat about January next year.

The other thing you should pencil in is the Port Phillip Publishing2014 conference, World War D: Cash, War and Survival in the Digital Age. Put your email around the hotlist if you’re interested. You’lmost all be eligible for an early bird provide but with no obligation. There’utes going to be a cracking line up of speakers. We’re not at liberty to say who just yet.

Speaking associated with money, it was interesting to listen to currency expert Jim Rickards now. Rickards, a gold bull, has long said the path of the US dollar is unsustainable. Therefor it will not be continual. Nothing about the recent ‘resolution’ of the debt situation changes that from all…

Two Countries Still Feeling the Press

As Rickards noted this week, the US debt, deficit and debt to Gross domestic product ratio are still going up. The discussion was never about cutting Government spending, it was about the rate associated with increase. It was never a real government shutdown, either, only a temporary stop in the US ability to proceed deeper into debt.

One downside from the US political gridlock would be that the future of the US dollar looks a bit dimmer in the eyes of the world. You’d think then that the long term for gold would look brighter. But you wouldn’t know it by looking at the price. Publisher Den Denning made his method north late this week to the 2013 Gold Symposium in Sydney.

He might’ve faced a more sceptical crowd compared to previous years. Gold has a date with its first down year in 13 years since the beginning of the bull run that saw it go from US$250 to in excess of US$1900. It’s currently trading around $US1300 but showing little sign of existence.

Over at the Daily Reckoning last week, your editor pointed out the physical gold marketplace is under some pressure. That’s because the largest market for gold is within India, and the government is trying to restrict gold sales to reduce the actual country’s trade deficit.

The Wall Street Journal reported that imports of the metal fell 90% in August as well as ‘the import curbs had implications beyond India’s borders as well as helped muzzle a large part of the global gold trade.’ Based on the article, refiners and traders in Switzerland and Dubai are feeling the downturn. In September the value associated with Indian gold imports dropped 82%.

Of program, these figures are based on official data. What nobody can really know is how much gold is smuggled within. The WSJ also noted that demand is beginning to fire up as India moves into its festival season, usually a time for gold buying. But premiums are high and precious metal supply is short. That suggests the actual smugglers aren’t meeting the need!

That’s the physical marketplace. But there’s some odd trades going on in the document market as well.

Robin Bromby in the Australian reported this week that last Friday a huge 2 million ounce sell order strike the exchange at the open up. It was ‘an order so big this triggered an automatic 10-second trading interruption (and a $US30 an ounce fall in the metal’s cost)…There was a huge order unloaded on October 1, too, and only then do we had that episode within April when, within 2 hours, 13.4 million ounces had been unloaded through Comex. Someone is determined in order to knock the stuffing out of gold.‘

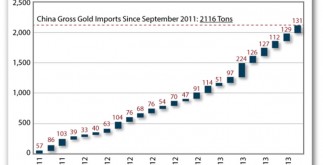

Whether any attempt to jerk the price around is just big bucks boys trying to work an advantage or something larger, we don’capital t know. Mr Brumby suggests the Chinese won’t mind, because they’ll be able to buy up more.

Bullion Versus Miners

Bullion buyers have the option to sit out the downside. That’s not a luxurious afforded to mining companies. They need money coming in. Greg Canavan, editor of Sound Money Sound Investments, has been operating the ruler over the gold miners. With gold at these types of prices, many gold miners will not only end up being not making money, they may not really have positive cash flow. Greg highlighted these studies from UK company Hinde Capital now:

‘From an investor’s perspective it is a treacherous minefield… While the big caps that comprise the GDX index are not likely to go out of business for the short term and may offer some trading opportunities for a bounce here, the very nature of this desperate company remains. Huge capital is needed a long time before there is even the sniff of future cash flow. All companies can go to zero but mining companies get there considerably faster than most.‘

Hinde’s research shows 109 global mining companies have endured falls of 90% or more from the height, with another 58 not far behind, down 80-90%. That’s shows you how savage this bear market continues to be. Their take is that gold bullion is an attractive proposition at the current price, but forget the miners for now. That sounds like something Jim Rickards might agree with. Stay tuned.

Callum Newman+

Editor, Money Weekend

From the main harbour Phillip Publishing Library

Special Report: UNAVOIDABLE: Australia’s First Recession in 22 Years