Goldman Made Greece Eurozone Crisis Worse – For Big Profit

Parthenon – Goldman Sachs Latest Purchase?

By David Caploe PhD, Chief Political Economist, EconomyWatch.org, 16 February 2010

By David Caploe Expert degree, Chief Political Economist, EconomyWatch.com, Sixteen February 2010

Chinese New Year / President’utes Day / Carneval – no matter in which you were in the world this weekend, it had been likely a celebration of some kind, where people focused on family / fun / festivities.

Which means, as followers of economedia © and Economy Watch well understand, it was the perfect time to bury any kind of bad or questionable news.

And when the subject is Goldman Sachs, that’utes usually when the New York Times falls another powerhouse article – playing the actual “double game” of credibility Or “but we didn’t really hurt you” in which mainstream media organizations attempting to make any claim to legitimacy so often engage.

So it’s hardly astonishing that – at a time when even a lot of “slow growth” Europe is getting ready to celebrate, despite the on-going financial stagnation – this Friday night in the US / Saturday morning in European countries was when the Times chose to release an explosive piece on how good old Goldman Sachs has been seriously involved in covering up what it right now turns out has been the Ancient greek government’s chronic mis-management of its condition budget and finances.

What – you imply GS has not only a) been betting against the mortgage-based securities it was selling its own clients; b) deeply implicated in the almost- and still-pending fall of AIG, the largest insurance company on the planet; but also c) helping to aggravate the already bad crisis in the Eurozone ???

Apparently so.

But if the Occasions has anything to say about it – and apparently they do, since the story was reported by not just the indefatigable Louise Story, co-author of the OTHER “hidden within plain sight” Goldman scandal stories cited over, as well as two other journalists – you’ll probably never know about it.

But that’s what Economy Watch is all about – to make sure you DO find out about these things, both here as well as on our increasingly-popular FaceBook Fan page:

Wall Street tactics akin to the ones that fostered subprime mortgages in America have worsened the financial crisis shaking A holiday in greece and undermining the euro by enabling European governments to hide their mounting debts.

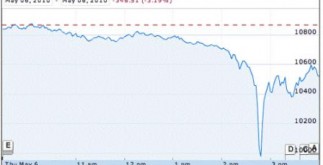

As worries more than Greece rattle world markets, records and interviews show that with Wall Street’s help, the country engaged in a decade-long effort in order to skirt European debt limits.

One offer created by Goldman Sachs helped obscure billions in debt from the budget overseers in Brussels.

As usual, the guys from GS waste no time and will work in ingenious ways – and eerily parallel to the tricks they and their buddies on Walls Street used to help obtain the US in the great shape it’utes in today.

In early November — three months before Athens became the epicenter of worldwide financial anxiety — a team from Goldman Sachs found its way to the ancient city with a really modern proposition for a government struggling to pay its expenses …

The bankers, led by Goldman’s president, Gary D. Cohn, kept out a financing instrument that would have pushed financial debt from Greece’s health care program far into the future, much as when strapped homeowners take out second mortgages to pay off their credit cards.

And apparently, the same kind of sordid maneuvers that worked so well in the US also go over just as easily in Europe.

It had worked prior to.

In 2001, just after Greece had been admitted to Europe’s monetary union, Goldman helped the government quietly borrow billions, people familiar with the transaction said.

That deal, hidden from public view because it was treated like a currency trade rather than a mortgage, helped Athens to meet Europe’s deficit guidelines, while continuing to spend past its means.

Hmmmm … does that problem ???

Using accounting sleight-of-hand to help people spend beyond their means – at least for a while, until the whole house of cards comes tumbling down – where HAVE we heard this before ???

Once again, the primary culprits are what Street. Warren of Buffet has called “economic weapons of mass destruction” – DERIVATIVES.

As in the American subprime turmoil and the implosion of the American Worldwide Group, financial derivatives played a job in the run-up of Greek debt.

Instruments developed by Goldman Sachs, JPMorgan Chase and a wide range of other banks enabled politicians to mask additional borrowing in Greece, Italy and possibly elsewhere. …

Such derivatives, which are not freely documented or disclosed, increase the uncertainty over how deep the troubles go in Greece and which other governments might have utilized similar off-balance sheet accounting.

The tide of fear is now washing more than other economically troubled countries on the periphery of Europe, making it more expensive for Italy, Spain and Portugal to borrow.

So how did it work ???

In a large number of deals across the Continent, banks supplied cash upfront in return for federal government payments in the future, with those liabilities then left off the books.

Greece, for instance, traded away the rights in order to airport fees and lottery proceeds in years to come.

Critics state that such deals, because they are not recorded because loans, mislead investors and regulators about the depth of a country’utes liabilities.

Now here’s where the parallels become even more disturbing – with the Western equivalent of the phrase that has become all too familiar of late in the American context: Too Big To Fail [TBTF].

The crisis in Greece poses the most significant challenge yet to Europe’s common currency, the euro, and the Continent’s goal of economic unity.

The country is, in the argot associated with banking, too big to be allowed to fail.

Greece owes the world $300 billion, and major banking institutions are on the hook for much of that debt. A default might reverberate around the globe.

So how did this complete relationship between Wall Road sharpies and – relatively – poor nations develop ???

Wall Street did not create Europe’s debt problem. However bankers enabled Greece and others to gain access to beyond their means, in offers that were perfectly legal.

Few rules govern how nations can borrow the money they need for expenses like the military and health care.

The market for sovereign debt — the Wall Street term for loans in order to governments — is as unfettered as it is vast …

Banks eagerly exploited what was, for them, a highly lucrative symbiosis with free-spending governments …

The 2001 deal between Greece and Goldman, for instance, netted GS more than $300 million.

Which is why Goldman and its fellow Wall Streeters were so anxious to help countries such as Italy and Greece circumvent the – allegedly – strict rules governing membership in the Eurozone.

But exactly how did this become a problem for those countries in the first place ? ???

For all the benefits of uniting Europe with one currency, the delivery of the euro came with an original sin.

Which is precisely the argument utilized by Paul Krugman in his despairing analysis of the Eurozone turmoil in general, and the Greek tragedy in particular.

So what was that “unique sin” ???

Countries like Italy and Greece entered the monetary union with bigger deficits than the ones permitted under the agreement that created the currency.

Rather than raise taxes or reduce spending, however, these governments artificially reduced their deficits with derivatives.

And that, of course, is where the boys from the Street arrived:

Despite persistently high deficits, the 1996 derivative helped bring Italy’s budget into line by swapping currency with JPMorgan at a favorable exchange price, effectively putting more money in the government’s hands. In return, Italy committed to future payments that were not really booked as liabilities.

In Greece, the bookkeeping was even much more creative than with Italy:

In exactly what amounted to a garage sale on a national scale, Greek officials essentially mortgaged the actual country’s airports and freeways to raise much-needed money.

Aeolos, a legal entity created in 2001, helped Greece reduce the debt on its balance sheet that year. As part of the deal, Greece got cash upfront in return for pledging future landing fees at the country’s airports.

A similar deal in 2000 called Ariadne wolfed down the revenue that the federal government collected from its national lottery.

Greece, however, classified those transactions as sales, not loans, despite doubts by many critics.

But however beneficial in the short-term, the long-range implications can be disastrous – as the current Greek crisis now sadly illustrates.

George Alogoskoufis, who became Greece’utes finance minister in a politics party shift after the Goldman offer, criticized the transaction in the Parliament in 2005.

The deal, Mr. Alogoskoufis argued, would saddle the government with big payments to Goldman until 2019.

And talking about yet another such swap,

Edward Stansted, a senior vice president at the Moody’s credit rating agency, stated the deal would ultimately be a money-loser for Greece because of its long-term payment obligations … “This swap is always going to be unprofitable for the Greek federal government.”

Which kind of sums up why both the US and now, it seems, Europe as well are going to face a mixed financial / economic crisis for the foreseeable future.

So enjoy Carneval / the actual Presidents’ Day weekend sales / & Gong Xi Fa Cai – because it looks like the hangover is going to be brutal.

David Caploe PhD

Chief Political Economist

EconomyWatch.com