Will Gold Follow Its Seasonal Pattern This Year?

I often talk about how the gold trade is actually two separate trades. There’s the Fear Trade that buys gold out of fear of war or even poor government policies. This crowd sees the precious metal as a safe haven during times of turmoil, such as when gold rose over the fear of a war in Syria, but eased when a much more limited military action became likely.

However, there were additional factors beyond Syria driving gold. That’s the Love Trade. This group gives gold as gifts with regard to loved ones during important vacations and festivals.

This is the time of the year that we are in the midst of right now.

Historically, September has been gold’s best month of the season. Looking at more than four decades associated with monthly returns, the precious metal has seen its biggest increase this month, averaging Two.3 percent.

Click to enlarge

Indians will be getting ready for their wedding period, which begins in October followed by the five-day Hindu festival of lights, Diwali, which is India’s biggest as well as most important holiday of the year.

In Dec, millions of people will be gathering along with loved ones to exchange gifts because they observe Christmas. And finally, millions will celebrate Chinese New Year in the end of January 2014.

In India, there’s also the harvest season to think about, as its crop production depends on rainfall for water.

One positive driver with regard to gold this year is the fact that the nation has had a heavy monsoon. The rains that started in June covered the majority of India at the fastest pace in more than 50 years. About 70 percent of the annual rainfall in India happens from June to September, and a strong monsoon season usually means a fender crop, which boosts farmers’ incomes.

That might increase gold buying as well, negating the government’s efforts to quell India’s gold-buying habit. Historically, good monsoon seasons have been associated with strong gold demand. ‘In 2010, the last year that rains were heavily above average, demand soared 37 percent in the 4th quarter after harvests,‘ states Reuters.

In the rural areas of India, there is little change access to banking networks, so gold is used as a store of wealth, says Reuters. And with half the population in India employed in agriculture, it’s no surprise that 60 percent of all the gold demand in the country comes from these rural areas.

India’s rural community has seen a ‘hefty rise‘ in earnings this year, reports Mineweb. But instead of buying gold, Mineweb says Indian farmers may purchase land due to gold in nearby currency reaching ‘dizzying heights‘.

Particularly over the past few weeks, as the currency faced increasing weakness, gold in rupee spiked. Over the past three years, gold has become up 58 percent compared to gold in the US dollar, which flower nearly 12 percent.

Click to enlarge

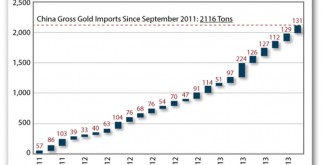

Despite this particular possible short-term threat to gold need, keep in mind the East’s long-term sentiment towards the metal. You can see this particular encouraging sentiment in the graph below, as people in India and china have a ‘particular positivity around longer-term expectations for that gold price,‘ according to the World Gold Council (WGC).

In May as well as July, the WGC asked 1,000 Indian and 1,000 Chinese consumers where they think the price of gold will maintain five years. The two charts display the respondents’ answers in May, once the average price of gold was about $1,400, and again within July, when the average cost of gold was $1,200 an ounce.

Click to enlarge

Overwhelmingly, consumers in India as well as China believe the price of precious metal will increase over the long-term.

What’s interesting happens when you compare the responses between May to This summer, there’s an ‘extremely resilient emotion around the future trajectory of gold,‘ says the WGC. In Might, 62 percent assumed gold would increase; in This summer, the number increased to 66 percent.

The survey also shows that there are not too many gold bears within the East. Only 11 percent of those who responded in This summer think the price will decrease.

Remember, this area of the world has a different relationship related to both the Love Trade and the Fear Trade. And it’s not easily broken.

Frank Holmes

CEO and Chief Investment Officer, U.S. Global Investors

[U.Utes. Global Investors, Inc. is definitely an investment management firm focusing on gold, natural resources, emerging marketplaces and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.]