Tremendous Currency Movement from the end of Last Year into the New Year

The US dollar turned in a mixed performance during the first week of the New Year. It fell against the Antipodeans and yen but rose against the other main currencies. The dollar’s performance against emerging market currencies had been similarly mixed. It flower against most but fell against the major non-restricted currencies, like the Turkish lira, the Mexican peso, and the Southern African rand. Most importantly, the buck finished the week on a gentle note, and we expect this to continue into the week forward.

US job creation in Dec, at 252k, surpassed consensus anticipations. Upward revisions for the October-November rolls were by a combined 50k. It had been the weakest monthly jobs growth since August. The actual wage data were a major disappointment. Average hourly revenue fell 0.2%. The consensus called for a 0.2% increase. The 0.4% gain in The fall of revision cut the number in half. The year-over-year pace slumped to 1.7%, the lowest in two-years.

The market’s confidence that the Fed’s lift-off will take place near mid-year has been shaken. The implied yield of the December 2015 Eurodollar futures contract finished the week at it’s lowest level in a month, almost 20 bp below the level seen on Christmas Event. In the week ahead, much softer retail sales and inflation gauges will likely favor the actual doves and weigh on the buck.

Technically, the euro could climb toward $1.1875-$1.1900 before the has make a new stand in front of the January 22 ECB meeting. This sort of gain off the multi-year low set on January 8 near $1.1755 does not likely reflect bottom-pickers and discount hunters as much as a minor round of short covering as the downside momentum appeared to ease. A break of the $1.1750 are could signal another quick penny decline.

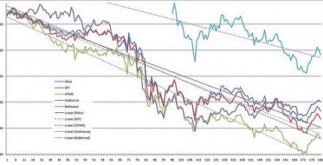

The dollar peaked one month ago against the yen (Dec 8 ~JPY121.85). Since then the actual BOJ has added another (approximately) 1.4% of GDP to the balance sheet. Over the past 30 days, the dollar appears to be carving out some kind of wedge or even triangle pattern, which is a continuation pattern. The downward sloping top line is drawn off that December 8 high which the high from January 2-3. It comes in near JPY120.35 by the end of a few days ahead. The upward sloping bottom line is off the December 16 low spike below JPY115.60 and also the January 6 low simply above JPY118.00. It shut just above it prior to the weekend. On a downside split, which looks likely, we initially target JPY117.50 after which JPY116.80.

After a string associated with disappointing PMI reports, the UK surprised investors with its biggest jump in manufacturing output within seven months and the smallest trade deficit since 06 2013. Sterling’s downside momentum had carried to just above $1.50 and the data helped encourage a bounce. Those upticks nevertheless lack conviction, and the short covering was only sufficient for this to flirt with $1.5175. Officially, there is potential into the $1.5250-$1.5300 area. Expectations of a rate hike continue to push out, reflected in the latest gains in the short-sterling futures contract. A sub-1% CPI reading is expected on January Thirteen and will likely push the market more in this direction.

The Australian dollar finished last week over its 20-day moving average for the first time since mid-November. Positive fundamental information from the smaller than expected industry deficit and larger than expected jump in building approvals appeared to stall the downside momentum. This took the broader US dollar weakness to drive it higher. It probed the actual $0.8200 area and the next level of resistance is actually near $0.8250. From a technical perspective, the Australian dollar looks the most constructive of the foreign currencies we look from here. The RSI and MACDs possess turned up, the 5-day moving typical is poised to mix above the 20-day average, and it shut at three-week highs before the weekend break. It also closed above the downtrend collection drawn off the mid- and late-November levels and the high at the start of the New Year.

The technical tone of the Canadian dollar is not nearly as good as it is for the Australian buck. The Canadian dollar is more like a petro-currency. This allowed the actual drop in oil prices in order to overshadow the 53.5k begin full-time jobs reported before the weekend break. The US dollar extended its advancing streak against the Canada dollar to six consecutive days. It approached CAD1.19 prior to pulling back a little. Above there, the CAD1.1975-CAD1.2000 offers psychological resistance. The lower degree is equivalent to $0.8350 for Canadian businesses.

Oil prices have fallen with regard to seven consecutive weeks. The risk is still on the downside, although the February WTI futures contract spent most the week bouncing along the recent trough. Saudi Arabia’s last move, to chop the discounts offered in the US and Europe, demonstrate it’s resolve to preserve share of the market. At the same time, the apparent liberalization people rules on condensate exports could increase US exports by another million barrels a day by the end of the year, according to some industry estimates. This will intensify the competition within third markets. Over time, the actual decline in prices will boost demand. There are already original signs that the decline within gasoline prices in the US is boosting demand.

The drop in essential oil prices, the absence of earnings development in the jobs report, and the increased jitters in the equity market, ahead of Q4 earnings season pushed US 10-year bond produces below 2.0%. This is beginning to look like the upper end of yields. Yields recorded a low near 1.86% in the mid-October expensive crash and 1.88% on January 6. A break could extend the range another Ten bp or so initially, but there’s increasing talk of a move toward 1.50%.

The S&P Five hundred filled the gap from the higher opening on December Eighteen that we anticipated. The recuperation off the January 6 low was sharp. In some ways, it looks similar to the middle of October and middle of Dec lows. However, the specialized indicators, like the RSI and MACDs aren’t as constructive. A break of the 2030-2065 range will likely suggest the actual direction of the near-term trend. Even though the weekly close was over the 50-day moving average, on balance we have a slight near-term bias to the downside.

Observations based on the speculative placement in the futures market:

1. There were two significant changes in yucky speculative position in the futures markets in the Commitment of Traders for the week finishing January 6. The gross short euro position elevated by 11.6k contracts to 207.1k. The gross short sterling placement grew by 10.4k to 64.7k contracts. There was only one other gross position adjustment more than 5k contracts. It was the 7.7k contract cut of gross long Australian buck positions to leave 17k.

2. There was a clear pattern. Speculators added to the gross short position of all currency futures we track. The longs were combined but were added to within the euro, yen, sterling and peso.

3. It appears as if there was some pre-holiday position squaring, and those positions are being re-established. The actual gross short euro position peaked in early November near 239k contract and fell to 183k in the middle of December. There are a few exclusions. The gross long and short yen positions are smaller now than mid-December, but the net position is little changed at 90.1k contracts short. Before Christmas, it was at 87k. The market has been creating a larger net short sterling position, which is now about 20% larger than it was on before Xmas. At 64.5k contracts, the net short peso position is about twice the size of the position at the end of The fall of.

4. The net short 10-year Treasury note commodity position slipped to 243k agreements from 261k the prior week. Nevertheless, this is still a large increase from the 163k net short placement in early December. The yucky long position rose nearly 30k contracts over the past week in order to 311.5k. In late October, the gross long position was 457k connections and fell to 273k agreements in the middle of December. It has increased for the past three weeks. The yucky short position increased by almost 12k contracts to 554.7k. This is actually the largest gross short risky position since 2006. It has grown by about 90k agreements since the end of November.

News Stream May Favor All of us Doves and Spur Dollar Consolidation is republished with permission from Marc to Market