Euro Machinations

The euro has shed six cents over the past seven periods. There are two main forces. The primary one arguably is within Europe itself. After an extended flash crash that saw German 10-year yields jump (from Five bp on April Seventeen to almost 80 bp in the first half of May), they’ve come back (to 53 british petroleum today). The ECB confirmed exactly what many had suspected. Specifically, that the ECB will expedite it’s bond purchases ahead of the slimmer summer markets.

Meanwhile, the situation within Greece is becoming more eager. The government, of course, is still spending money, but is falling deeper in arrears to its providers as it hoards cash so it can repay the IMF. This recently had to borrow from the reserve account at the IMF so it could make the debt payment to the very same IMF. These machinations are taking a larger toll on the economy and also the Greek banks, which nevertheless appear to be bleeding deposits.

European officials talk tough and let you know that the Eurozone is better prepared to cope with Greece than it was in 2010-2012. Whilst no doubt this is true, it is near the point. As the Greek tensions escalate, contagion is still evident. Over the past week, as Germany's 10-year bund yield slipped 5 bp, Italia and Spain's benchmark produces rose 13 and Eleven bp respectively. Much of it took place today. Although the electoral successes of the anti-austerity Podemos in Spain's weekend local elections may have weighed upon sentiment, Spanish bonds have not under-performed Italian bonds today. Under a Grexit, the EMU would be reversible, and investors could very well demand a risk premium.

The second factor that has weighed on the euro is better news from the US. The economical data suggests that Q2 is indeed dealing with what looks like another contraction in Q1. The weakness within the March non-farm payroll report was a bit of a fluke. April employment bounced back and the four-week average associated with weekly initial jobless statements made new cyclical lows. Leading Fed officials have made it clear that they still assume the opportunity to hike rates later this year.

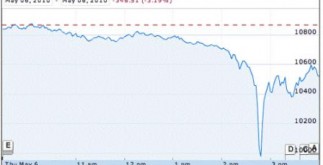

With this backdrop, let's look at the euro's price motion. The euro's low so far this year was on 03 16 just below $1.0460. It retested the low on April Thirteen near $1.0520. The euro flower to a high a little beneath $1.1470 on May 15. The Great Graphic, created on Bloomberg, shows the Fibonacci retracements of the 2-month euro rally.

Taking the rally from the March 16 low, the 61.8% retracement is about $1.0845. The retracement should be from the April 13 low. If so, the 61.8% retracement is a little over $1.0882, violated in North America today.

Below the $1.0845 area, chartists see support in the $1.0680-$1.0720 area from prior congestion. In addition, a trend line drawn off the 03 and April lows comes in near $1.06 at the end of the week and $1.0620 on June Five, the release of the next non-farm pay-roll report.

The RSI has edged beneath 40. A couple of days before the 03 low it was near 15. The MACD's crossed lower about a week ago. The pace of the euro's sell off though, has been very sharp, and also the euro is trading below its lower Bollinger Band (~$1.0910). It is not easy to talk about meaningful nearby opposition, but on ideas the euro will not resurface above the $1.1000-20 area, look for short-term traders to market into a bounce that could extend toward $1.0950.

Great Graphic: Euro Retracements is actually republished with permission from Marc in order to Market