The Yuan as a Reserve Currency Partly Hinge on China Adopting IMF Best Practices

China reported that its currency reserves fell for the third consecutive quarter in the three months ending on March 31. The dollar value of reserves dropped, $113 bln to $3.73 trillion. Over the three quarter period, China's reserve holdings have fallen by roughly $263 bln.

To appreciate what is occurring in China it is useful to place it within the global context. IMF COFER data covers only through the end of last year. In the Q3 and Q4, the IMF estimates which world reserve holdings dropped by almost $390 bln. The PBOC reviews that its reserves fell by about $150 bln over the same time period.

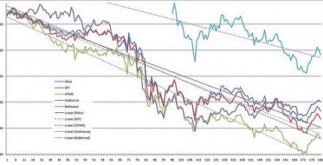

The decline in global supplies of which China, then is really a subset, appear driven through two forces: valuation as well as capital outflows. The euro, sterling, yen and other reserve currencies lost value when converted into dollars. For example, by the IMF's reckoning the value of global reserves fell by about 3.3% in H2 14. During this period, the euro misplaced 12.5% of its value. The actual yen fell by 19% as well as sterling slipped 3.7%. All else becoming equal, the dollar's appreciation exerts downward pressure on the value of global reserve assets.

In addition to valuation adjustments, a strong dollar may have encouraged funds outflows from some countries, especially emerging markets. Some of these flows are from the private sector as foreign investors repatriated funds. A few flows appear to have been from the official sector. One of the key reasons why central banks, especially in emerging markets, build reserves is to keep their own currencies weak. When the dollar is strong, they have no need to push it higher. To the contrary, when the US dollar is strong, central banks can liquidate (take profits?) on some of their dollar holdings and/or intervene to slow the descent of their currencies, contrary to the forex war meme.

Both valuation considerations and capital outflows explain the decline in China's reserve figures. China does not report the actual currency allocation of its supplies. This could change in the not too distant future. If China wants to increase its chances that the yuan is going to be included in the SDR basket, it behooves it to adopt the IMF's best practices, which means reporting the allocation of its reserves. Although the IMF's report does not reveal country specific data, the market will begin to try to back out the new info and by doing so will like have a good sense of China's allocations.

In the H2 14, as China's reserves fell by $150 bln, it documented a merchandise trade excess of $278.5 bln. In Q1 15, reserves fell by $113 bln having a $123.7 bln trade surplus. The gap between the two exaggerates the portfolio capital outflows because other factors, like a deficit on services and foreign direct investment, matter in addition to the valuation adjustment.

Conduct a simple physical exercise. At the end of last year, China kept $3.84 trillion in supplies. We do not know the euro's reveal, but let us assume it is about the same as those that report forex allocations, which is 22.2%. The euro fell by 11.3% on Q1. That alone could account for $96 bln of the $113 bln decline in reserves that China documented earlier today.

When the dollar is depreciating, Chinese exporters have little incentive to hold on to bucks and likely turn them over towards the PBOC. China has begun a liberalization procedure and exporters have greater discretion. In a rising dollar environment, there is less need to covert to yuan.

This is an important point. Below conditions of a falling dollar, the dollar value of supplies tends to increase. Under problems of a rising dollar, the actual dollar value of reserves has a tendency to decline. Part of the internationalization of yuan which has captured so many imaginations is really a function of a bull marketplace. Now that the yuan is not so easily a one-way bet, the internationalization has slowed. It reveal of trade settlement below SWIFT fell in two places to seventh and an industry survey found that the percentage of companies settling trade in yuan fell to 17% from 22%.

A survey by the Central Banking Publications study of central bankers last month found two interesting advancements. First, central banks asked estimate that by the end of this season, the yuan will account for Two.9% of global reserves. Second by 2025, its share will increase to 10%.

The former seems a bit on the high side. Global supplies stood at $11.6 billion at the end of 2014. Assuming no change in reserves over the course of the year means some $336 bln of yuan in reserves at the end of 2015. Among the $6.085 trillion of reserves where the allocation is actually reported, there was $191 bln in other currencies, where the yuan (alongside a number of other currencies, including Sweden, Norway, and Singapore would be discovered). A 2.9% allocation to the yuan could be worth about $176.5 bln.

There tend to be $5.515 trillion of unallocated reserves. Of which we know that China makes up about the $3.84 trillion. That leaves $1.675 trillion. Of those, a few 8.65% would need allocation to the yuan to meet the 2.9% survey results. It seems to be a stretch.

That said dramatic liberalization could take place that will make it easier to conceive. For example, currently, for the most part, leaving aside a few of the nuances of the Hong Kong-China equity marketplace link, foreign investors, such as officials, require Chinese authorization to buy yuan or mainland ties. However, there is front-page commentary within the China Securities Journal arguing to scrap the current allowance system under QFII and RQFII.

This might be putting the proverbial trolley before the horse. The training that Chinese officials appear to have drawn from both Russia's experience and the East Asian economic crisis (1997-1998) is that before opening the main city account, it is essential to ensure a strong banking system. China offers liberalized lending rates, but not down payment, rates. In order to liberalize deposit prices it needs to introduce deposit insurance. There are some indications that such program can be unveiled as early as next month.

Toward Understanding China's Reserves and Yuan as a Reserve Resource is republished with permission through Marc to Market