The Divergent Monetary Policy Theme and the Dollar

The US dollar has been on a roller coaster ride. Many have lost confidence in the underlying trend. An important prop for the dollar, namely the prospects for the Fed's lift-off, extends again, this time ostensibly due to the heightened unpredictability of the financial markets, apparently sparked by events in The far east.

The September Fed funds futures have nearly fully listed out the risk of a hike next month. The effective Given funds have traded 14-15 bp this month, and the September Fed funds contract suggests an average effective rate of 17.5 bp next month.

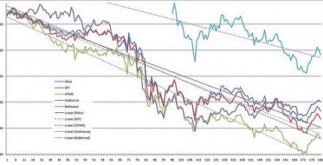

We continue to believe that the main driver of this third significant dollar rally since the end associated with Bretton Woods is the divergence of the flight of monetary policy between the US (and UK) and nearly all the other high income countries, and lots of emerging markets, including The far east. There are a number of cross currents, and other considerations, including marketplace positioning, use of euro as well as yen for funding reasons, and hedging flows which at times may obscure or perhaps reverse (technical correction) the actual trend.

Nevertheless, we expect the actual divergence theme to gain more traction over time. The Federal Reserve may raise rates at some juncture and not only will the ECB and BOJ continue to ease for at least the next 12 months, but there is danger that the central bank stability sheet exercise lasts a lot longer. The ECB's staff, which will update its forecasts in the week ahead, is likely to cut both its growth and inflation forecasts at the September 3 central bank meeting.

The Dollar Index slammed to its lowest level since January in the market panic at the start of last week. This overshot the minimum objective from the double top pattern we noted (~94.30). It rebounded as well as on Thursday had retraced nearly Sixty one.8% of the decline since the July 7 (~98.33). The trend line drawn off that high and also the August 19 high (~97.’08) comes in near 95.Eighty on Monday and drops to about 95.15 by the end of the week. A move above Ninety six.40 would signal a return of the 98.00-98.30 area.

The panic saw the dinar reach almost $1.1715 at the start of last week. The subsequent sell-off saw it shed a lot more than nickel. The euro settled on its lows for the week, leaving a potential shooting star candlestick formation on the every week charts. The break associated with $1.12 creates scope for an additional half cent of diminishes but pushing the euro below the $1.1130 area may require fresh fundamental incentives, possibly by means of more confidence that the Fed is still on track to hike rates next month, or that the ECB is particularly dovish. On the upside, the $1.1280-$1.1310 band should limit dinar gains if the euro bears squeezed out of their shorts re-establish.

Switzerland suddenly reported that its economy broadened in Q2. The consensus had been expected the second consecutive quarterly contraction. That helped booth the dollar's upside momentum. The CHF0.9680 is a potent block now to additional dollar acquire, though if overcome, the following target is near CHF0.9800. Assistance is near CHF0.9500. Support for that euro is at CHF1.0750 and then CHF1.0700. A rest of CHF1.0680 would mark a substantial technical deterioration.

The dollar additionally retraced 68.2% of its losses against the yen of the drop from August 18 high close to JPY124.50 through the spike have less August 24 near JPY116.20. Overcoming that retracement objective close to JPY121.35, a band of resistance exists in the JPY121.80-JPY122.15 which will provide the next test. Around the weekly charts, the buck posted a potential bullish sludge hammer pattern. An appreciating buck against the yen assumes firm, if not rising US prices, and stability to higher equities.

The greenback rose against virtually all of the currencies last week save japan yen. Sterling was among the poorest. Losing about 2.20%, sterling nearly matched up the Australian dollar's decline (2.25%), only surpassed by the New Zealand dollar's 3.35% fall. Since August 18, the implied yield on the June 2016 short sterling futures contract dropped more than 13 bp because investors anticipate that greater deflationary forces will delay the BOE rate hike.

Sterling fell to its lowest level since July 8 before the weekend. A persuading break of the low established then (~$15330) could spur an additional drop into the $1.5180-$1.5200 area. Sterling shut below its 100-day moving typical (~$1.5480) for the first time since early May. It has spent most of the last two months above the 200-day moving typical (~$1.5370) as well. On the weekly graphs, sterling posted a large outside lower week, which is a bearish development. On the top side, the $1.5450 area ought to offer resistance.

The Australian buck tested a monthly trend collection dating back to 2001. It is near $0.7025. Assisted by a head and shoulders bottom on the hourly bar charts, the Aussie dollar bounced a little through $0.7200 before the sellers re-emerged. It ceased shy of the measuring objective of the head and shoulders pattern, which seems to reflect the aggressiveness of the bears. Even though there is no expectation that the RBA may cut rates when it fulfills on September 1, they’ll likely not rule out the next cut. A rate cut gets to be more likely if the currency stops falling. Look for another check on the $0.7000-$0.7025 support.

Canada's basic principles are poor and this appeared to outweigh the recovery within oil prices. In addition, the US two-year premium over Canada recouped most of the ground it had lost earlier in the 7 days. Canada expects to statement a contraction in Q2 Gross domestic product in the coming days and a softening of the labor market in August. The US dollar's pullback in the CAD1.3355 spike on August Twenty five fizzled near CAD1.3140. Another run at the highs looks likely. Over the longer term, we look for the Australian dollar to fall towards $0.6000 and the US buck to rise toward CAD1.40.

Oil costs staged a strong rebounded in the other half of last week after falling to $37.75 on August 24. The bounce carried the October light crude futures contract to $45.25, which completes a Sixty one.8% retracement of the slide in prices since July 29. The next objective is near $46.Eighty and then $48.00. There is great momentum, and the October contract finished the week above it’s 20-day moving average (~$42.95) for the first time since June 23. The October contract posted a possible key reversal on the weekly bar charts. It made a new multi-year low early in the week and then proceeded to rally, taking out the previous week's highs. It closed at its highest level since the finish of July.

The 10-year US Treasury yield plunged to 1.90% in the stress at the start of last week. As markets calmed and economic information, including durable goods purchases and a sharp upward revision to Q2 GDP helped yields recover by 30 bp before consolidating. Some link the rise in US yields to selling by Chinese authorities. While we do not rule out a few Treasury sales, we suspect exaggeration, as is the market's wont.

Note that the TIC data, which is not complete, but authoritative, shows China's holdings of US Treasuries rose by about $27 bln in H1 14, the most recent data. The Federal Book custody holdings of Treasuries with regard to foreign officials rose through about $26 bln this month, which includes $9 bln liquidation over the past two weeks. We assume yields can move back into the 2.20%-2.25% range. A stronger barrier in yields may be closer to 2.33%.

The S&P 500 recoup half of what it lost once you have registered the record high on August 18 near 2103 to the panic low near 1867 on July 24-25. That retracement is near 85. Small penetration of this did take place, but buying grew shy ahead of the 2000 tag. The 61.8% retracement is close to 2013, and additional resistance is likely near 2050. Support is incorporated in the 1940-1945 area. While the technical factors appear constructive, with a potential bullish hammer candlestick design on the weekly charts, advancements in overseas markets are a wild card.

Observations based on speculative positioning in the futures market:

1. The actual CFTC reporting week ending July 25 saw large swings in currency prices and several significant (10k contracts or even more) adjustments of speculative yucky futures positions. The gross long euro and yen positions jumped 19.3k contracts (to 87.8k) and 14k (in order to 59.9k) respectively. A Thirty seven.1k contract decline in the risky gross short position displays a powerful short squeeze.

2. The actual gross short Australian dollar position jumped by 13.6k contracts to 111.0k, which makes it the second largest gross short position after the euro. The euro's gross short position cut by 7.3k contracts, departing 153.9k still short. The gross short Mexican peso position jumped by 18.4k contracts to 103.5k.

3. Although there were minor adjustments in the speculative gross sterling placement, they were sufficient to switch the net position from short in order to long for the first time since Sept 2014. The bulls added 6k contracts towards the gross long position, that now stands at 58.1k contracts. The bears cut the gross short placement by 1.2k contracts, leaving 54.8k. The net lengthy position stands at 3.3k contracts.

4. The general pattern was adding to longs and cutting shorts for the euro, yen, and sterling. Speculators added to gross short Canadian and Australian dollar positions and the Mexican peso. Speculators trimmed gross wishes of these currencies, except for the Canadian dollar.

5. Given the following price action over the July 26-28, we suspect that some of these new positions were unwound in the euro and yen. Sterling drop in the second half of last week warns that some of the late longs may have also been reduce. Sentiment still appears extremely negative toward the dollar-bloc.

6. The web long US 10-year Treasury futures tucked to 1.3k contracts from 7.3k. Gross longs and pants were cut. The bulls sold 58.4k contracts, leaving the actual gross long position from 395.2k contracts. The has covered 52.4k gross brief contracts, leaving 393.9k.

7. The net lengthy speculative light sweet oil futures positions were pared through 5k contracts, leaving 215.6k. Given the large movement in prices, it is surprising to see exactly how small of a position adjustment took place. The longs added 1k contracts, lifting the yucky position to 474.2k contracts. The bears trimmed their own gross position by 4k agreements, leaving 215.6k.

The Dollar: Now What? is republished with permission from Marc to Market