Gold: The Link Between US Treasury Tricks and Chinese Housewives

Last week, while tensions ramped up in the center East (and despite the Russia-Syria-US ballet associated with oddball diplomacy, tensions remain higher), the price of gold plummeted.

What happened? Let’utes have a look at that, and more!

Well, last week a representative from Goldman Sachs (the share cost of which is about to become part of the Dow Jones Index, by the way) mentioned that the price of gold might drop in order to below $1,000 per oz. That lowered the growth on gold.

When Goldman speaks, individuals listen. Then they sell or buy appropriately. Goldman moves markets. I’ll refrain from saying more on that specific stage.

Other Forces Work Against Gold

Aside from Goldman, much of the mainstream press is already working against gold and other precious metals like silver, platinum and palladium. Precious metals aren’t any longer the flavour of the month, a minimum of like they used to be.

After the great, decade-long run, precious metals have retracted in the past year. Is it a brief issue for long-term investors? Or is something fundamental really changing for gleaming stuff? It matters with regards to the value of physical metal that you personal, and definitely for the prospects of mining companies in which you might commit.

The ‘paper price’ for gold, etc. has been on a downward slide year over year – for example, the price for each ounce is down over $400. The actual redeeming thing is that, for much of The year 2013, we’ve had strong assistance for gold, silver, and so on. in the form of physical purchasing on pullbacks.

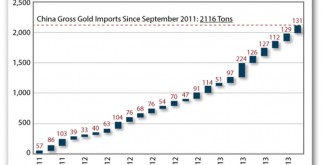

Stories are now legendary regarding ‘Chinese housewives’ mobbing gold selling counter tops of Shanghai. Or great company accounts of clever smugglers bringing precious metal into India in defiance of presidency controls. Are new tales like these – anecdotal evidence for the ‘adore trade’ in gold – about to dry up?

Or consider news stories about how emerging, hot-running markets of the past few years are on the ropes. The bloom is distinctly off the flower for prospects in, state, China, India, Brazil, Poultry and many more former go-go lands. Their government-administered, goosed-up economies have outrun the kind of fundamentals – household savings and company profits – that make for long-term economic strength. Bad for gold, right?

Improving Traditional western Economies

Meanwhile, developed economies appear to be improving by many metrics. Just look close to home in the US, where housing had a good summer and automobiles are rolling off the lots from rates not seen because before the Crash of 2008.

Also in the US, the dollar is robust relative to other world currencies. I contend that much of the latest ‘dollar strength’ is due to increased domestic oil output, courtesy of our ongoing energy revolution, also known as fracking. With fracking, the US has displaced about 2.5 million barrels-per-day of imported oil.

Now instead of imports, the US economy uses domestic raw, much to the benefit of the actual overall economy, tax receipts, the national current account and more. Indeed, the large increase in domestic essential oil is one development for which Curr. Obama never seems to ‘blame Bush’.

Overseas, European economies are improving. Look at Indonesia, Britain and others. There’s less and fewer bad news from the southern edge (Italy in particular), which could be a sign that things have stopped getting worse and have found a bottom. Is there a rebound coming?

Japan is looking up too, despite lingering effects of the 2011 nuclear plant disaster at Fukushima. 1 Japanese highlight is that the International Olympics Committee just awarded the actual 2020 event to Tokyo. We can look forward to seven strong years of people in Japan pouring cement for new stadiums, roads, rail, airports, etc. And you just realize that the Japanese will want to outdo their own rivals in China, who hosted the 2008 Olympics in Beijing.

So is the Precious metal Run Over?

With all this good news for ‘conventional’ economics, and not so good news for the gold-demand side, is the gold run over? Are we waiting for the golden Godot or something?

Well, not so fast. At least, don’t rush for that exits. All is not what it seems. Let’s look at one item – just one – that could cause precious metal prices to come back sharply.

You may know that for many several weeks the US Treasury Department has been cooking the books on national accounts. Well, that’s things i call it when the US national debt has not budged by a dollar, while the debt level continues to be levelled-off at $16.7 trillion – that just so happens to be the current, congressionally-mandated debt ceiling.

Throughout 2013, the Treasury has used accounting gimmicks, tricks, fund transfers, restatements and other legerdemain to handle the books. But in per month or so – or as soon as the financial debt ceiling is raised following Congress and Pres. Obama go through their Kabuki Theater – the united states national debt will quickly go back upwards.

That is, national debt will quickly land on some much higher number, as Treasury’s accounting tricks loosen up and the debt magically seems on the federal balance sheet.

So why does Goldman Sachs believe that gold is due for another pullback to under $1,000? Do investors no longer need precious metal as a risk hedge? Is the modern economy past the point exactly where savers and investors have to convert currency into something which central banks can’t create out of nothing?

You should keep these questions in mind as you watch the gyrations of gold prices. We might have a rough patch in front of us, with painful down-swings in precious metal prices and related mining gives. But beware trying to ‘market-time’ this particular.

Just keep in mind that over the long haul, precious metal and other precious metals are a key part of preserving your wealth. Don’t panic out. Goldman Sachs does stuff that are good for Goldman, not a person.

That’s all for now. Thanks for reading.

Byron King

Contributing Editor, Money Early morning

Ed Note: The Real Chinese Housewives Of Gold Buying, Treasury Tricks And More! originally appeared in The Daily Reckoning USA